Rex sale lands but there’s no cheap flight guarantees

Travelers traveling to the region may be in luck with a troubled airline on the brink of rescue, but it remains unclear whether ticket prices will actually drop.

US carrier Air T plans to buy troubled Australian airline Rex 15 months after it went into administration, administrators have confirmed.

However, while the sale still needs to be approved by creditors who will meet in the coming weeks, shareholders are expected to be left with nothing.

Federal Transport Minister Catherine King said the proposed purchase was welcome and would help Rex strengthen its aircraft fleet after a $130 million taxpayer-funded bailout helped keep it afloat.

The regional airline operates obsolete Saab aircraft and the minister noted that Air T has access to a large collection of similar aircraft and spare parts.

“Hopefully it will be possible to have a few more aircraft operating in Rex’s fleet,” he told ABC radio on Wednesday.

“We need to complete this creditors meeting and then of course the business needs consolidation… and then our view is pretty firm that we will look at expansion.”

But University of Sydney transport and supply chain expert Rico Merkert said there were few markets into which Rex could expand.

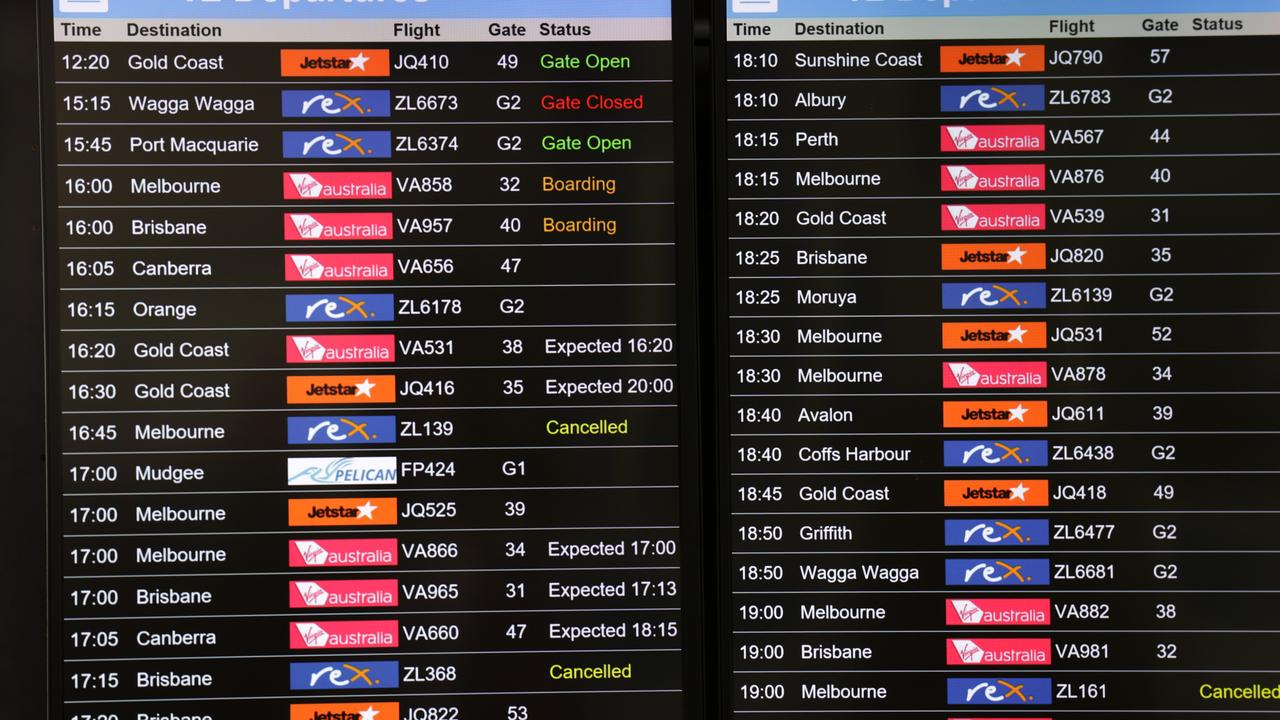

Before going into administration the airline had a robust network across Australia.

“We think they should focus on that and get back to profit,” Professor Merkert told AAP.

The reason for Rex’s failure was its attempt to compete with Qantas and Virgin on major city routes, including Sydney, Melbourne and Brisbane, where the aviation duopoly dominated.

“I think this expansion into the triangle was a huge mistake,” Prof Merkert said.

Since the company collapsed, the federal government has purchased $50 million of its debt and loaned up to $80 million to ensure regional and remote communities can continue to access flights.

Asked whether the money taxpayers poured into Rex would be refunded or whether the change would lead to cheaper flights for consumers, Ms. King’s office declined to comment, citing sensitivities around the ongoing sales process.

However, Prof Merkert said he hoped the agreement would include a provision for the return of taxpayer funding.

He also suggested the acquisition could lead to cheaper flights on some regional routes because the business would run more smoothly after administration.

Air T said it had reached an agreement with the Commonwealth to restructure Rex’s financing arrangements but did not provide further details.

“(We) will work to ensure Rex continues to operate on a sustainable basis, providing critical services to Australians in the region,” the company said in a statement.

The union representing aviation workers is holding a meeting with the US company, demanding that it guarantee the future of regional routes and the security of workers’ wages and conditions.

Transport Workers Union national secretary Michael Kaine said there were still significant questions about Rex’s long-term future.

“Regional Australia is too often left behind when it comes to aviation, and now more than ever we need certainty about the future of Rex,” he said.

Opposition transport spokeswoman Bridget McKenzie said the government needed to clarify which routes Rex would run under its new ownership and whether prices would change.

Australia’s Associated Press is the beating heart of Australian news. AAP is Australia’s only independent national news channel and has been providing accurate, reliable and fast-paced news content to the media industry, government and corporate sector for 85 years. We inform Australia.