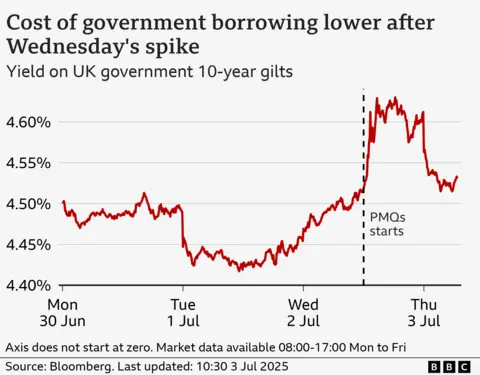

UK borrowing costs fall as investors’ nerves ease

Worker correspondent

Getty Images

Getty ImagesThe cost of government borrowing fell into early trade and partially reversed a fluctuation of the chancellor’s emotional appearance in Commons the previous day.

The return of the UK 10 -year bonds, the markets, Rachel Reeves and the Prime Minister’s “working in Lockstep” reacting to the comments of 4.61% to 4.52% at the closing of Wednesday to 4.52%.

Pound, which also fell on Wednesday, rose to $ 1,3668, although it has not recovered all its lost floor.

An analyst told the BBC that financial markets support the chancellor and he is afraid that if he abandons his job, the government will weaken control over the finances.

“It seems to me that this is a rare example of the financial markets that improve a politician’s career expectations.” He said.

“I think the markets, if the chancellor goes, any financial discipline will follow him through the door and this means that it will mean greater explanations.”

Queens’ College, Cambridge and Allianz Chief Economic Advisor President Mohamed al-Eerian warned that the markets will remain on the sidelines.

“When you put a risk premium on the market, it is very difficult to remove.” He said.

“I suspect that we will see a little moderate, but we will not return to our location 24 hours ago.”

One reason why sharp movements in bond returns are important for individuals is that they can have an impact on the mortgage market and higher returns make potentially mortgage agreements more expensive.

In particular, increases or decreases in five -year bond returns may be fed by the debtors’ swap rates used to price new fixed mortgage agreements.

This was clearly explained after the mini budget during the premiere of Liz Truss.

Mortgage rates are late, lenders compete for customers while making relatively small cuts.

When Reeves became emotional and began to cry, the government was in the Prime Minister’s questions on Wednesday after the U -turn of the government’s plans to cut billions of pounds through welfare reforms.

Reverse of welfare reforms makes Reeves’ financial plans for almost £ 5 billion in black holes.

The increase in borrowing costs has been released with the feeling that the chancellery could resign at the beginning and seems to show that the markets support it.

A treasure spokesman later said that the chancellor was upset about a “personal issue”.

On Wednesday evening, Prime Minister Sir Kier Kier supported Starmer Reeves and said that BBC Radio 4 worked with Nick Robinson and his political thought with Reeves “Lockstep” and “a chances of chances”.

Reeves said that the financial rules were “bargaining”. The first is that daily expenditures should be paid mainly with government income, which is mainly taxes. Borrowing is only for investment.

Jane Foley, the president of the FX strategy in Rabobank, said that the “encouragement of the prosperity” encouraging “makes the job of the chances, because” the planned savings will not come. “

As a result, Reeves said that he was facing tax collection, reducing expenditures elsewhere, or raising more government debt.

“However, investors place many stores in political stability. Reeves showed an understanding of the importance of maintaining financial discipline, and it is unclear who will replace it and have the same reliability between the investment community.

“Thus, Starmer’s faith in Reeves gave a little assurance to the market this morning.”