What the Budget means for you and your money

Kevin Peachcost of living reporter

Getty Images

Getty ImagesChancellor Rachel Reeves is announcing her Budget but the details have been published earlier by the official forecaster.

It is full of policies that will directly affect you and your finances.

Here are the basic precautions and how they will affect you and your money.

You may pay more taxes

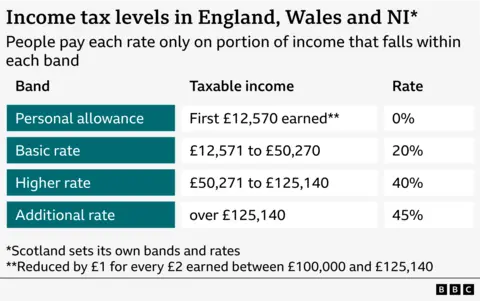

The amount of income on which you pay income tax at different rates will still not increase in line with rising prices.

Instead groups – are known as tax thresholds – It will remain frozen until 2031. This is three years longer than previously planned.

This means that any wage increase could push you into a higher tax bracket, or you may find that a larger portion of your income than expected is taxed.

Scotland’s own own income tax rates.

You may not earn enough to pay income tax, so VAT paid when buying goods and services may affect you more and this remains unchanged.

Driving an electric car will become more expensive

Electric vehicle and hybrid vehicle drivers will be taxed for using the road starting from 2028.

EV drivers will be charged per mile along with other road taxes. new road prices.

It is difficult to calculate the number of miles driven by drivers.

But fuel tax will continue to be frozen.

If your salary is low, you will get a raise

Chancellor confirms increases for employees in April minimum wage.

It means:

- Eligible workers aged 21 and over on the National Living Wage will receive £12.71 per hour instead of £12.21

- If you’re 18, 19 or 20, the National Minimum Wage increases from £10 to £10.85 per hour

- The minimum wage for 16 or 17-year-olds will rise from £7.55 to £8 per hour.

The separate apprentice rate charged to eligible under-19s or over-19s in the first year of an apprenticeship will also rise from £7.55 to £8 per hour.

You’ll pay more tax if your home is worth £2 million

Anyone living in a house worth £2 million or more in England will face a council tax surcharge from April 2028.

There will be four price ranges, with the surcharge rising from £2,500 for a property valued at £2 million to £2.5 million, to £7,500 for a property valued at £5 million or more, the highest value range.

Although it is known as mansion tax, it may also cover homes in expensive areas and will be levied on around 100,000 properties, mainly in London and south-east England.

The move will require homes to be assessed within the top council tax bands F, G and H for the first time since 1991.

If you’re here, you can check your council tax band here. England and Wales, ScotlandAnd Northern Ireland.

Traveling by train in the UK won’t cost you more

Organized railway fares In the UK, it will be frozen until March 2027 without being changed for the first time in 30 years.

These fares include season tickets covering most commuter routes, some off-peak return tickets for long-distance journeys, and flexible tickets for travel in and around major cities.

Getty Images

Getty ImagesThe freeze relates only to travel within the UK and also applies to services operated solely by UK-based train operators.

Train operators are free to set prices for unregulated fares.

A £3 single journey bus fare cap, which covers most bus journeys in England, is in place until March 2027.

You can get more money if you have three children

Currently parents are only eligible for universal credit or tax credit for their first two children.

The chancellor says hat with two children It will be scrapped in April next year.

Limit on the amount you can save into a pension through salary sacrifice

One third of private sector employees and one tenth of public sector employees use smartphones. salary sacrifice scheme for retirement savings.

These workers give up part of their wages in exchange for their employers paying the equivalent of their pension. The benefit to both employee and employee is that they save money on national insurance.

A cap of £2,000 per year on the amount that can be transferred to pensions through this salary sacrifice arrangement will apply from April 2029.

Employees will still receive Income tax deduction on pension contributionshowever, some argue that this move will reduce retirement savings incentives.

Most benefits and state pensions will increase

Some benefitsAll basic disability benefits such as personal independence payment, care allowance and disability living allowance, as well as carer’s allowance, will increase by 3.8% in April, in line with rising prices.

There will be a series Changes to universal credit in AprilFollowing previous statements made by the government.

state pension There will be a 4.8% increase in line with average wages in April, which means:

- The new flat-rate state pension for those reaching state pension age after April 2016 will rise by £574.60 to £241.30 per week, or £12,547.60 per year.

- For those who reached state pension age before April 2016, the old basic state pension will rise by £439.40 to £184.90 per week, or £9,614.80 per year.

Generally, you must have 35 years of qualifying contributions to receive a full state pension.

This brings the state pension closer to being subject to income tax, which has caused some controversy. This will also reignite debates about the “fairness” of so-called justice. triple lock.

More about milkshake tax, prescription fees and Mobility

A number of other measures included in the budget have also been clarified or announced in recent days. These included:

- The UK tax on fizzy drinks will be expanded to include dairy-based products in 2028. pre-packaged milkshakes and coffees They are high in sugar. It can push prices upor may lead to content changes

- Single person cost NHS prescription in England It will be frozen at £9.90 for the second year in a row in April

- Disabled people with cars mobility chart will not be allowed anymore “premium” vehicles such as BMW, Mercedes, Audi, Alfa Romeo and Lexus

- UK mayors may be given powers to file criminal charges tax on overnight staysSometimes referred to as the ‘tourist tax’. Mayors will decide the amount of the fee and how the money will be spent in their areas as part of the plans that will be consulted.