Budget 2025: Brexit, COVID debt and energy support schemes haunt Rachel Reeves’ crucial statement

A.Familiar debates are taking shape as the UK prepares for its budget announcement. Should Chancellor Rachel Reeves cut welfare spending? Or will the “triple lock” on state pensions be reformed?

Other debates focus on revenue: how to raise money without breaking Labour’s manifesto promise not to increase taxes on workers.

But these discussions are taking place in a strange vacuum, with no mention of the three huge expenditures that have brought Britain to this point.

COVID debt, energy support plans and Brexit have fundamentally shaped the UK’s financial woes. But voters and politicians seem determined not to talk about these issues.

Instead, they are seen as shocks imposed on the country, even though they involve hugely important political choices.

A somber tone accompanies this Christmas budget, and Britain’s strange collective amnesia is preventing the country from learning the lessons needed for future crises and talking honestly about the best route forward.

The ghost of COVID past

The COVID pandemic has required an unprecedented government response. Between 2020 and 2022, support measures totaled £169 billion, or 7 per cent of UK GDP, according to estimates from the Office for Budget Responsibility, the UK’s spending watchdog. The bulk of it (£100bn) was used in direct support for things like the furlough scheme.

In hindsight, the vaccine rollout was a pivotal moment in which the country demonstrated its ability to deliver success on a large scale. Some other decisions were less grandiose.

There was a general lack of transparency in the purchasing of healthcare equipment during the first wave of the pandemic, and the Eat Out to Help Out scheme to support hospitality led to a further rise in infections.

But there is little discussion of the most important, unanswered questions. Despite a lengthy inquiry examining the government’s failings, there has been no debate about how much risk we are willing to take as a country and how much we are willing to pay to reduce that risk.

COVID support plans increased public debt from 80.4 percent of GDP in 2018 to 107.4 percent in 2021. The government paid close to zero interest on the debt at the time.

But now high interest rates make this a huge burden for taxpayers. Debt interest expenses are higher than the education budget; More than double that in 2018. This is why Reeves appears so determined to reduce Britain’s debt levels.

We also know about the cost restrictions that apply to school children. But we know little about the costs of doing less or the current choice to stop vaccinating people.

Perhaps the biggest blow to the UK’s budget capacity comes from a global pandemic that could happen again in the future. The focus is on getting finances back on track, without discussing how to manage similar trade-offs next time.

The specter of our current energy transition

When Russia invaded Ukraine and energy prices rose, the UK faced a choice: reduce demand or subsidize consumption. He chose the latter.

The government has stepped in with massive support packages to pay people’s energy bills. This cost £78.2 billion, or more than 4 percent of GDP (an average of less than 3 percent in Europe).

About the author

Renaud Foucart is Senior Lecturer in Economics at Lancaster University Business School, Lancaster University.

This article was first published by. Speech and is republished under a Creative Commons license. Read original article

There were strong arguments in support of this approach. It would be terrible to allow fuel poverty to increase during a cost of living crisis and there is little time to target this policy. But to clarify what happened: huge subsidies were given to the public so that they did not have to change their lifestyle, technology or consumption patterns.

This happened in the middle of an energy transition. Ostensibly, the aim is to decarbonise, reduce dictators’ dependence on fossil fuels and modernize infrastructure.

These are complex decisions that require public support, some sacrifice, as well as a clear collective commitment that change is inevitable. However, the country, which has just proven that the government will step in when energy costs increase, does not approach these challenges this way.

Like the Covid-19 debt, UK taxpayers are bearing the cost of the energy subsidy debt and sweeping the decisions that caused it under the rug.

The specter of Brexit has not yet emerged

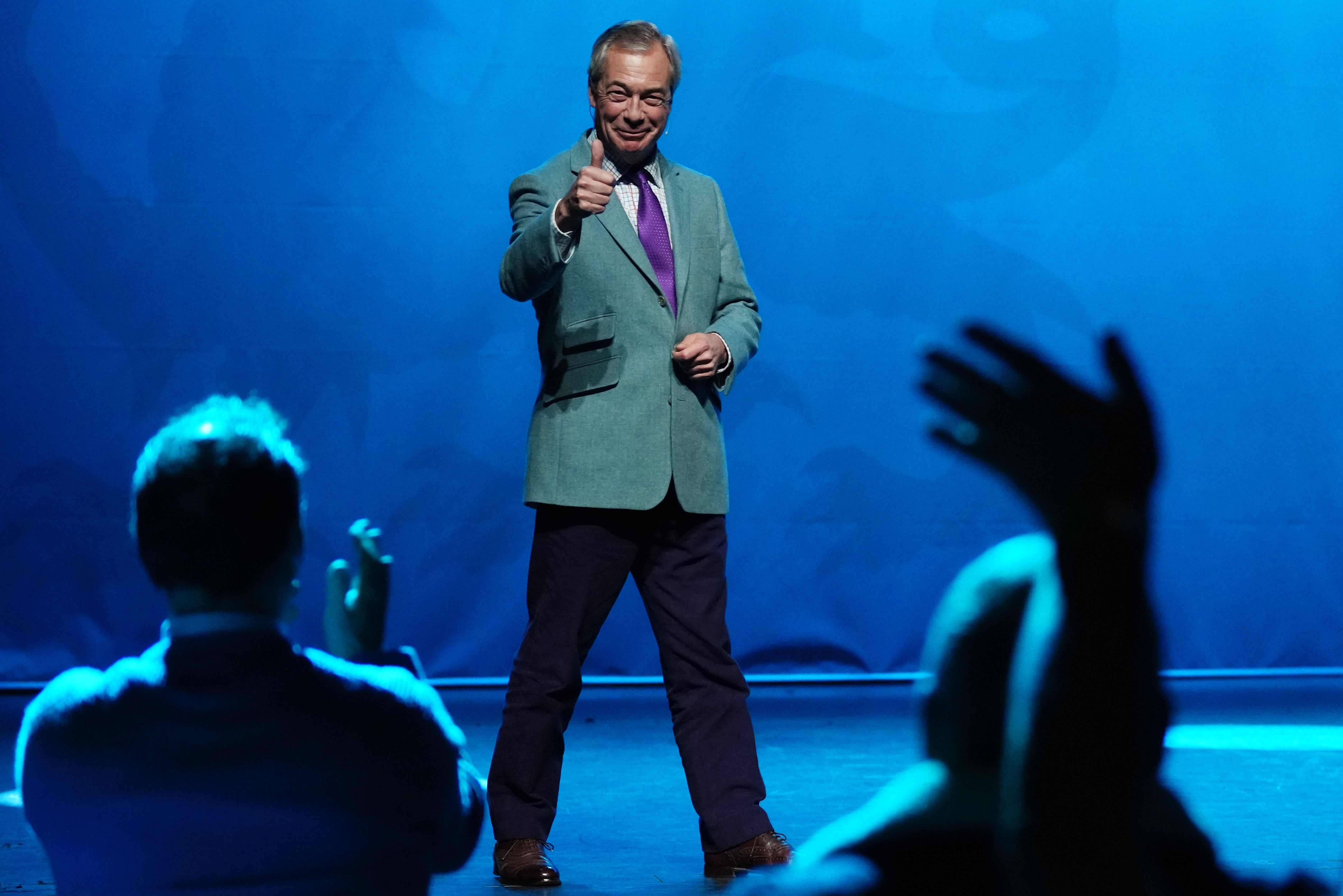

Britain’s relationship with Brexit looks more complicated than ever. Just 11 per cent of British adults think Brexit is more of a success than a failure, and 56 per cent would vote to rejoin the EU. Yet while many say Reform UK leader Nigel Farage is the frontrunner to become the next prime minister, they also blame him for the failures of Brexit (among others).

This may be because Brexit has largely disappeared from the public radar as Prime Minister Keir Starmer begins to move towards greater integration with the EU.

Conversations on the subject tend to do everything to prevent old wounds from reopening. But economists are slowly becoming aware of the extent of the damage to the economy. An unprecedented comprehensive study, based on comparisons with other countries as well as detailed data from Bank of England business surveys, estimates that Brexit reduced UK GDP by 6 per cent to 8 per cent. These figures were at the most pessimistic end of the forecasts at the time of the referendum.

To put this into perspective, given that the UK’s tax revenues are 40 per cent of GDP, a 7 per cent higher GDP would earn the Chancellor an extra £77bn a year. This is more than half of the 2024-25 budget deficit of £137bn.

However, no major trade agreement has been made with the US and no major initiatives have been taken to replace the EU. The UK is paying a heavy price for choosing one of the hardest possible versions of Brexit, but it has yet to define what kind of economic gain it could bring.

Covid debt, energy support and Brexit deficit are three specters that will haunt this budget; Ghosts that no one wants to face. The UK cannot prepare for future outbreaks without learning how it handled Covid-19.

It will not complete the energy transition without confronting choices about who will bear the costs of energy security. And it will not be able to develop a coherent economic strategy without considering what to do with Brexit. Until the UK confronts these problems it will have to debate minor austerity measures and hope for a Christmas miracle.