How much tax do Britain’s billionaires pay? HMRC has no idea, damning report finds

A strong Commons Committee has no idea how much of the taxi collects from billionaires among the calls for a reserve tax.

While Rachel Reeves is looking for billions of pounds to attach a gap hole to public financing, HM income and customs (HMRC) cannot determine how much tax is paid by British billionaires.

Although it is relatively few billionaires and the group contributes to the government’s ballot boxes, the Public Accounts Committee (PAC) said that HMRC is “how many billionaire taxes it has paid in the UK or how much it contributes in general.

The authority does more “and do it to understand that it pays the richest tax.

While the sharp warning pressure on the chancellery to bring a reserve tax on his budget this autumn this autumn, Ms. Reeves must make billions of pounds tax hike or expenditure deductions to meet the financial rules of Mrs. Reeves.

The government’s planned benefit deductions argued that after the chaotic U -5 billion -annual savings of £ 5 billion, the ministers should target the rich to compensate for the deficit.

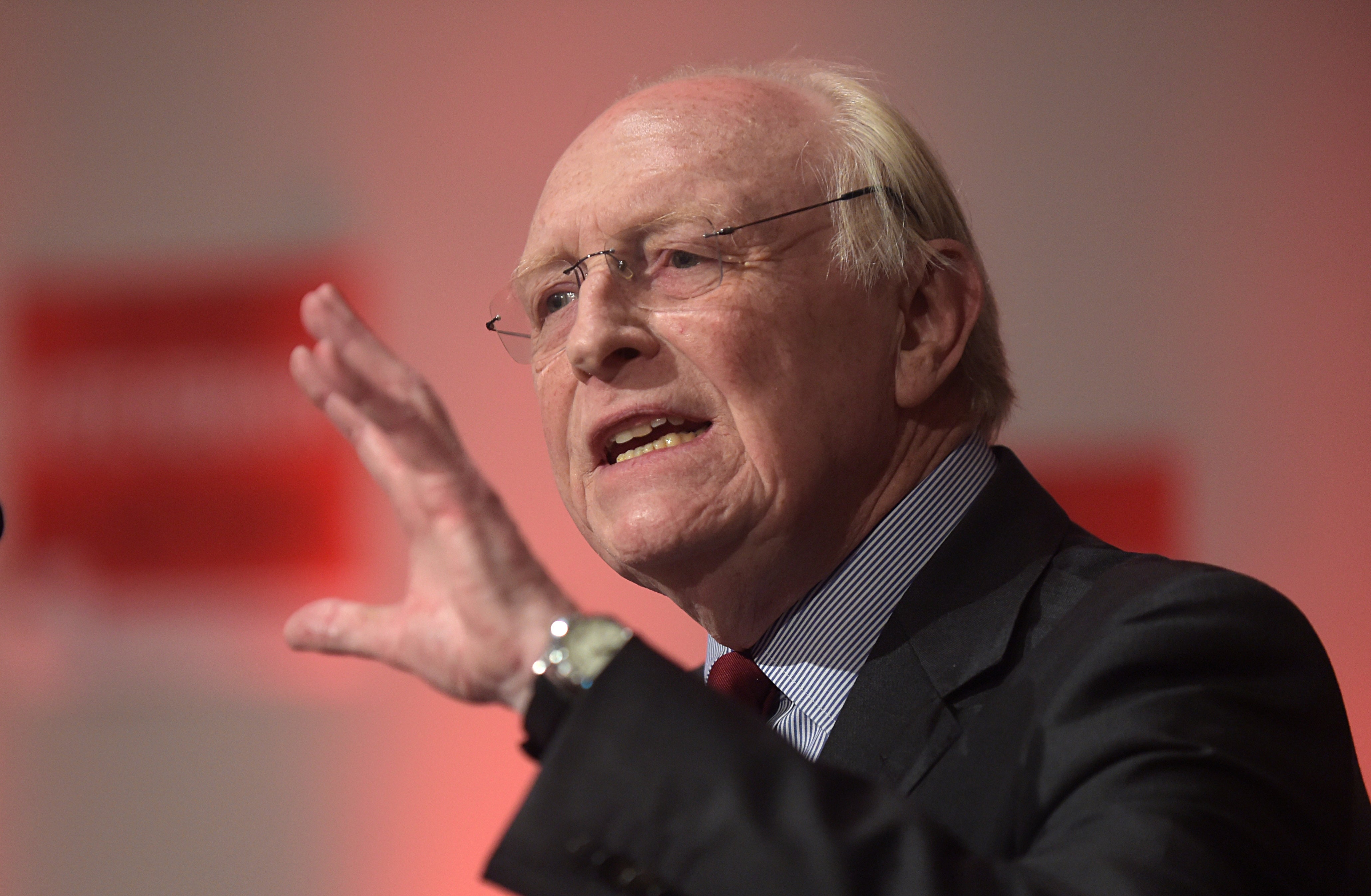

They were supported by former workers’ leader Lord Kinnock, who called for a 2 percent tax for assets over 10 million pounds. He claims that he can rise up to £ 11 billion per year and help Britain support his finances.

Sir Keir kept the option on the table and increased the fears of a super -rich migration from England. Analysis by consulting has left a total of 18 of the British billionaires of the British wealth more than other countries in the last two years.

PAC’s warning about HMRC reacted among the deputies who carried out the campaign for the reserve tax, and the Labor Party Left Happy Kim Johnson condemned the super -rich ability to öyle operating in secrecy ”.

He told me Independent: “This says everything about the priorities of this government – focusing more on examining more richness. Rachel Reeves’ arbitrary was said to be“ money için for public services under its self -imposed financial rules, but there is no effort to find out if the richest is indebted.

“We need political will to ensure that those with the largest shoulders carry more of the burden. But instead, a system that allows billionaires to be hidden in the shade. This is not a technical failure – this is a deliberate political election.”

Johnson added: “In which world is acceptable to operate in confidentiality, the working class is bored at every opportunity?”

Workers Deputy Nadia Whittome Independent The UK needs a tax system that covers gaps and guarantees the fair shares of rich individuals ”.

“This should start with the government to do more to understand how much taxes it pays and the super -rich one to understand more taxation opportunities.”

Campaign Group Tax Justice, England, said that PAC findings weakened public faith in the tax system. Temporary Director Fariya Mohiuddin said, “In the center of this story, HMRC has an urgent need for resources and political support for an effective and efficient tax authority that can implement a fair and appropriate tax system for the 21st century.”

PAC emphasized Sunday Times The rich list and artificial intelligence (AI) are the ways in which the income organ can dig deeper into deers and beings.

He wants HMRC’s plan to increase the tax return from wealthy taxpayers to publish both at home and at the open sea.

He said that HMRC did not collect information about the wealth of taxpayers and collected the data required to manage the tax system only in the way that the British tax legislation requires.

In the report, he said: “The rich payment has a lot of public interests to the tax amount.

“People need to know that everyone pays their fair share.”

The report may include how HMRC can start comparing existing data on known billionaires, such as the Plan of Developing Leaders and its Understanding of Retures and Heritage, and the current data on the market Times Rich List.

In the report, internal income service in the US worked with researchers to connect data to Forbes 400.

He added that HMRC is “much more” in which he can do to improve the risk of evaluating and targeting wealthy people by hiring data and technology use and asset management experts.

“This report is not about political debate about the redistribution of the reserve.

“The role of our committee is to help HMRC to do its job properly by allowing rich people to pay the right tax.

“Although HMRC deserves a big loan to secure billions of taxes from the richest in recent years, there is still a very long way before reaching a real accounting of debtors.

“We know a lot about the billionaires living in the United Kingdom with a lot of information about tax affairs and their rejoice in the public sphere.

He said: “Therefore, we were disappointed to find that all organizations could not give any idea of their HMRC’s taxes – especially considering that any of these individuals can make a significant difference for the general painting.

He continued: “We found a lack of curiosity about how wide the tax gap is both rich and for the reserve hidden in the sea.”