Inpex and Australia’s gas rip-off. Billions in revenue, crumbs in tax

An investigation into Inpex and its massive Ichthys gas project reveals the systemic failure of Australia’s tax system and some corporate nonsense. Josh Barnett And Michael West report.

When INPEX seeks approval to develop Ichthys gas field In 2008, Australians were promised decades of shared prosperity. 40-year project lifespan. Billions of dollars in economic benefits. A country that will be richer for allowing one of the world’s largest LNG developments to extract and export its gas.

More than a decade after initial production, the numbers tell a very different story.

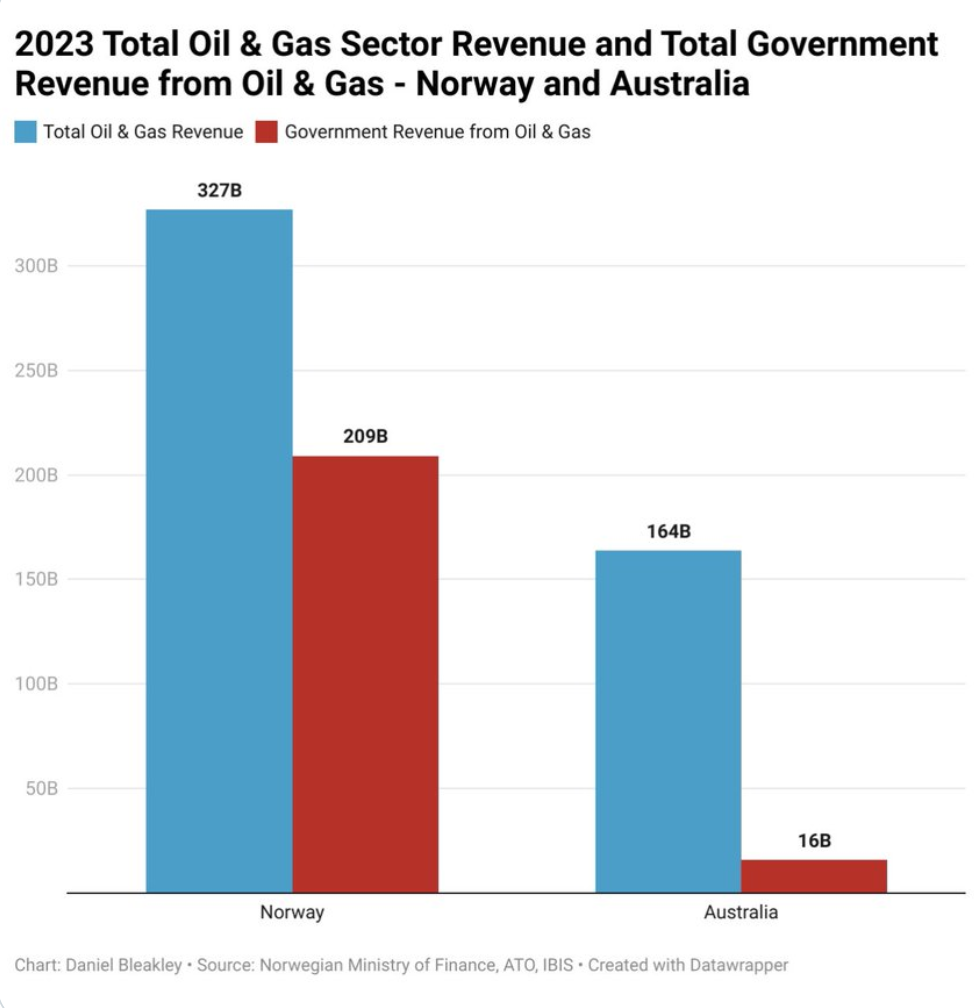

INPEX’s Australian entities made more than 2017 bookings, Australian Taxation Office transparency data shows $36 billion revenue in the last 11 fiscal years. Over the same period, they paid less $500 million corporate tax. They did not pay any fees for years.

Inpex. Source ATO

As energy prices rose globally in FY23, INPEX entities generated more than $9 billion in revenue in Australia. Their taxable income that year was only $23.5 million. The tax paid amounted to $6.7 million, which is approximately 0.07 percent of income.

Inpex’s reasoning

Responding to MWM’s questions, Inpex defended their tax structure by pointing out that tax is paid on taxable income (or profit) rather than income (or total income).

Although the Tax Office uses total income as a key measure of tax avoidance, this is true because multinational corporations leave the bulk of their tax liabilities between total income and taxable income limits.

The corporate tax rate is 30%; but 30% of zero is zero.

A large part of this money obtained from ‘total income’ is withdrawn abroad with the interest on loans received from the relevant companies, before it becomes ‘taxable income’. Inpex is certainly not alone. It is standard industry practice to prevent tax ‘escapes’.

Chevron, Exxon, Shell and others are also aggressively engaging in this practice of ‘debt loading’, transfer pricing and other aggressive tax reduction schemes.

In general, the aim is not to make a profit because the tax is collected on profit.

It is also fair to point out that the huge capital investments in these gas projects delay tax for years quite legally, as Inpex points out. All of this brings us to the heart of the matter: the systemic failure to generate enormous wealth from the resources available to all Australians.

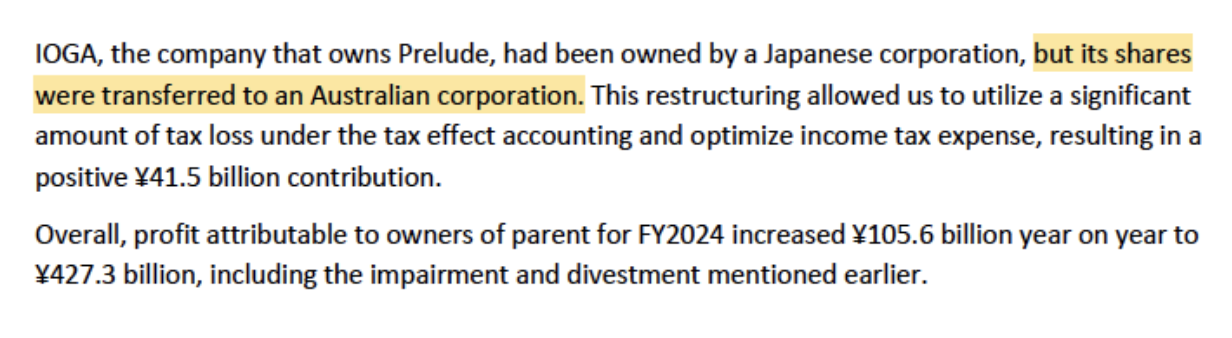

This is a failure made clear by the fact that Norway and the likes of its sovereign wealth fund are seizing this wealth for their own citizens rather than funneling it to foreign shareholders.

Source: Daniel Bleakley

Norway’s sovereign wealth fund has provided $350 billion to its citizens in 2025. Norway taxes natural gas at 78%.

Baby steps, baby tax

So after ten years Inpex starts paying a large amount of taxes, but compared to the income it is not much.

In FY24, INPEX’s tax payments increased sharply. $356.7 million paid Open Total revenue $7.63 billion. But the increase comes after years in which the group’s Australian entities generated billions in revenue while paying little or no corporate tax.

Its flagship Ichthys LNG project has never paid corporation tax in Australia despite generating tens of billions of dollars in revenue since production began. This leads to another problem with the tax system and its approach to foreign entities exploiting Australia’s resources.

Profits on one project are tax deductible (i.e. no tax is paid) against tax losses on another project. In other words, foreign multinational gas companies have been earning huge revenues for years and have paid no taxes.

“Optimizing tax” is part of the business model

INPEX does not hide its approach to tax. Announces this to its shareholders

in it February 2025 results presentationThe company’s executives told shareholders they would “continue to optimize” income tax and then explained the business rationale in plain language:

“To put it bluntly, if we can reduce our income tax expense by 1% of ¥900 billion, our profits will increase by about ¥10 billion.”

Reducing tax is considered a simple profit lever.

INPEX’s years of enormous revenue streams from its local entities are accompanied by minimal taxable income and little or no corporate taxes paid.

nonsense

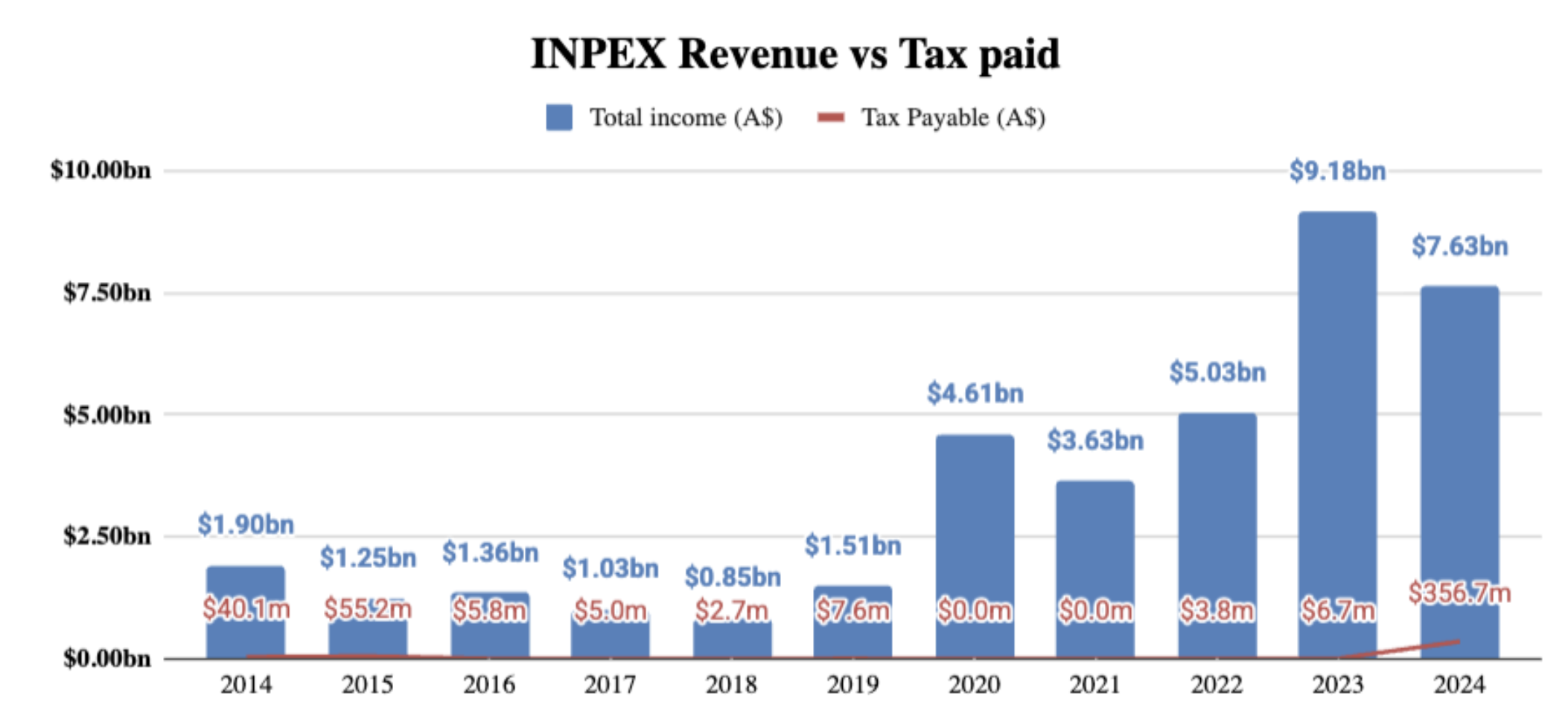

The shareholder presentation shows how central the tax implications are to the business model. In its FY2024 results briefing, the company announced a group restructuring that includes IOGA, the entity associated with the Prelude asset.

shares were transferred from a Japanese company to an Australian company.

INPEX said the restructuring “allowed us to leverage significant tax losses under tax impact accounting and optimize income tax expense.” “Positive contribution of ¥41.5 billion” make a profit

Source: Inpex

On the face of it, this appears to be a direct admission that Inpex fabricated this restructuring in order to avoid tax liabilities.

This type of practice, i.e. paper shuffling, is highly questionable. If this is done primarily to avoid tax, it is illegal under Australia’s tax laws, but it is notoriously difficult for authorities to prove fraudulent ‘intent’. What were going through the minds of Inpex directors and managers, its auditors EY and its tax lawyers as they contemplated the ‘group restructuring’?

Source: ATO

Subsidize losses, privatize profits

INPEX’s Australian gas empire wasn’t built on private capital alone; It is also made possible by taxpayer-funded infrastructure designed to serve the fossil fuel supply chain.

The clearest example of this Middle Arm in DarwinA major industrial expansion promoted as “sustainable development” but widely criticized as a gas and petrochemical hub by another name.

Greenwashed: How the new ‘Middle Arm’ fossil fuel hub was rebranded green

Albanian Government made a commitment at least 1.5 billion dollars While Middle Arm is in Commonwealth equity for its “common user” infrastructure, the Senate inquiry referred to the Commonwealth injection as follows: $1.9 billion.

The NT Government then committed to: $27 million for the region. In other words, the platform is funded by public money. But in parallel, Australia’s fossil fuel tax regulations continue to allow multinationals to defer obligations and minimize payments for years; This means the construction is publicly financed while profits are exported and tax collections remain weak.

In other words, governments assumed the risk, while companies assumed the returns. And once the infrastructure is built, the Australian public does not share this positive development. Inpex’s Australian entities generated tens of billions of dollars in revenue, exported millions of tonnes of gas, all returning little in company tax and zero royalties or PRRT.

As the Australia Institute’s Mark Ogge outlines, Inpex exports more gas each year than the combined amount used by all consumers in NSW, Victoria and South Australia, and pays no royalties and PRRT.

PRRT, the tax that never seems to arrive

The Petroleum Resources Rental Tax (PRRT) is expected to impose penalties on super profits from offshore oil and gas after projects have recouped their costs. In effect, companies are able to accumulate deductible expenses, research, development and financing costs and carry them forward in increments from year to year, so that the “rent” remains negative on paper while LNG exports continue apace.

INPEX paid $0 on PRRTand a report from The Australian Institute notes that no gas company paid PRRT for exported gas. INPEX itself does not expect to pay PRRT at least 2030. Meanwhile, it exports approx. 9 million tons of LNG per yearmore gas than homes and businesses use Combined NSW, Victoria and South Australia.

Questions to Inpex

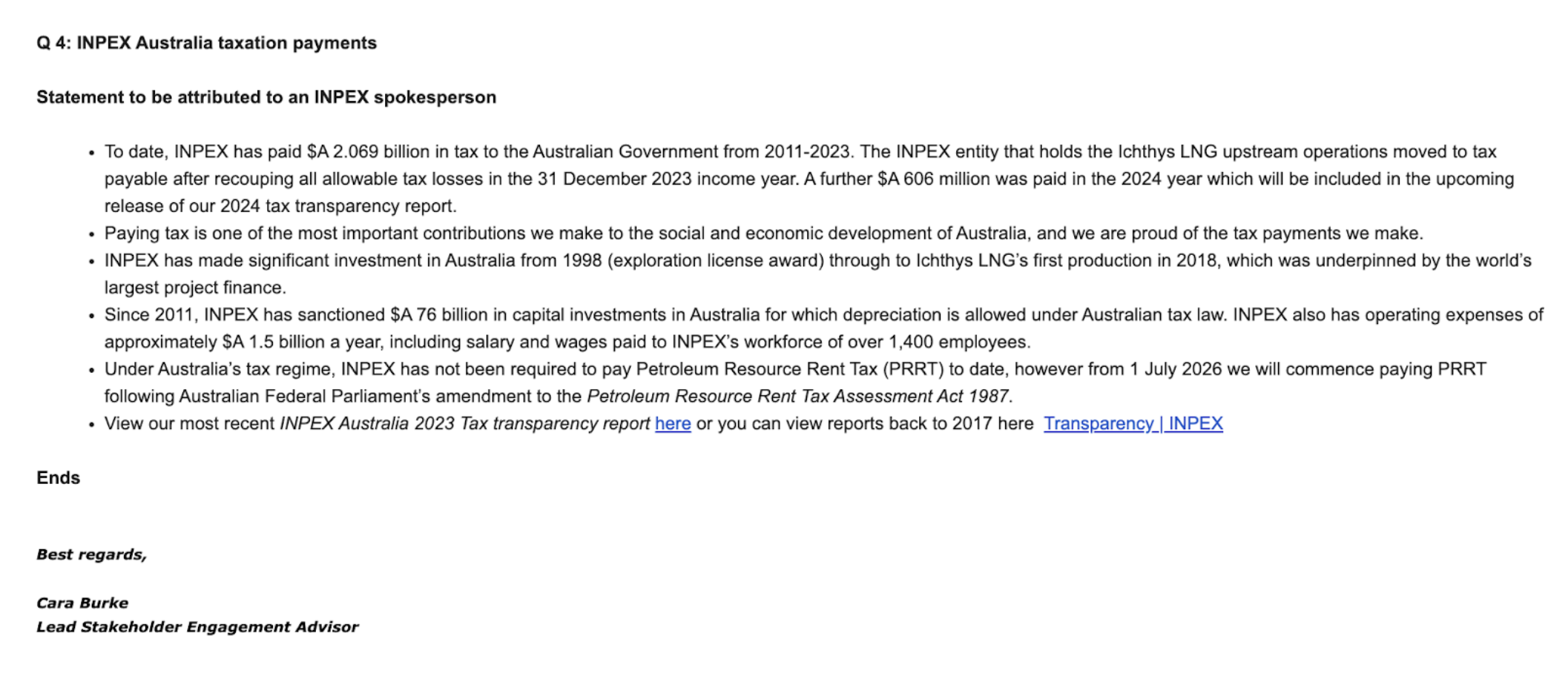

In response to our questions about tax, INPEX argues that comparing income to tax paid is misleading because corporate tax is paid on profit after depreciation and not on income.

The company states that it paid $2.069 billion in taxes from 2011 to 2023, with an additional $606 million in 2024, after which Ichthys became “tax payable” in the December 31, 2023 income year after allowable losses were recouped. INPEX marks $76 billion in capital investment since 2011; Operating costs are approximately $1.5 billion per year and a workforce of over 1,400.

It confirms that it has paid $0 in PRRT to date, but says it will start paying PRRT from July 1, 2026, following amendments to the PRRT Assessment Act.

But the story is the gap between revenue and profit and who designed it. Depreciation, deductions, loss carryforwards, and increases can cause taxable income to remain low for years while exports continue to flow. The result is predictable, less company tax and delayed PRRT; the public left footing the collective bill for infrastructure, regulation and the wider risk to Australia’s gas environments.

Source: Inpex