Is Taiwan Semiconductor a Better Buy Than Intel for 2026?

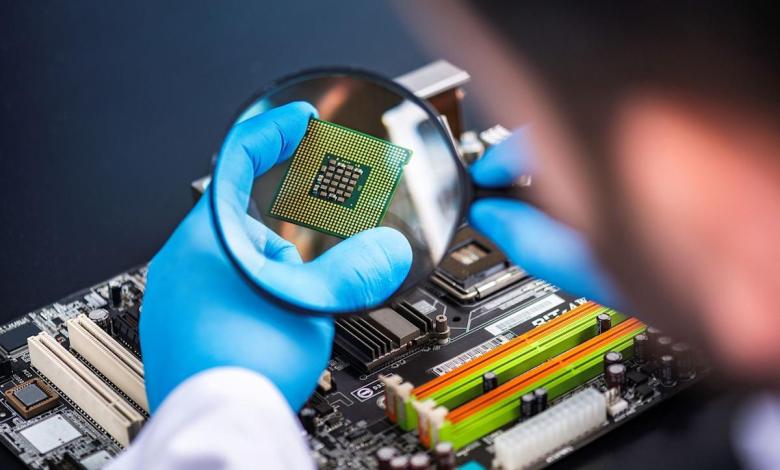

semiconductor chip industry Perhaps more than any other, it is a business sector on which the modern world is built. No matter what device you’re reading this on, this wouldn’t be possible without semiconductors.

for a long time, Intel (NASDAQ: INTC) was the undisputed world leader in semiconductor manufacturing, but today this title is Taiwan Semiconductor Manufacturing (NYSE: TSM).

And if you’re looking for a semiconductor investment for 2026, then you should bet on the purebred, not the purebred.

The country of Taiwan is the last remnant of China’s pre-communist republican government. It is also where 60% of the world’s semiconductor chips are produced and 90% of the most advanced chips come from.

Most of these chips are manufactured by Taiwan Semiconductor Manufacturing, better known as TSMC. The financial situation of the company also confirms this. TSMC generated $121.3 billion in revenue in 2025, an increase of 37% compared to 2024. Over the last three years, its revenue has grown at a compound annual growth rate (CAGR) of 20.48%. It also routinely beats earnings expectations and is incredibly profitable, with a 58.98% gross margin and a 43.29% net income margin.

Also note that TSMC pays a dividend that yields 0.99% at current prices; This is quite impressive considering the share price is up 66% in the last 12 months. The company has also increased its dividend by 12.3% annually over the past five years. Compare this to Intel and it becomes pretty clear that TSMC is unlikely to give up its throne anytime soon.

Despite the heavy blow from the US government, Intel’s revenue has fallen by an average of 8.4% over the past three years. Gross profit margin is only 33%, while net income margin is a razor-thin 0.37%. This means that in terms of net income, Intel is only marginally profitable. It’s also worth noting that Intel has suspended its dividend until late 2024 and plans to start paying it again soon.

Intel’s trailing 12-month (TTM) revenue is less than half of TSMC’s, its TTM diluted earnings per share (EPS) is just $0.05 versus TSMC’s $1.99, and TSMC has nearly three times as much cash as Intel, between $90.25 billion and $30.94 billion.