It’s not just Sam Altman warning about an AI bubble. Now Mark Zuckerberg says a ‘collapse’ is ‘definitely a possibility’

Deutsche Bank This is “Summer AI is ugly. “For weeks, with every new evidence that companies failed in AI’s adoption, the fears of a Balloon intensified, Topheavy The S&P 500 grew with the warnings of senior industry leaders. An August work from MIT, 95% of AI pilot programs Although it is poured over $ 40 billion into the area, it cannot provide investment return. Just before MIT’s report, Openai CEO Sam Altman AI Bubble alarm bells, Concern Over -valuation of some AI initiatives and the intensity of investor enthusiasm. These trends attracted the attention of FED President Jerome Powell. remarkable He witnessed an unusual large amount of economic activity in the creation of artificial intelligence capabilities of the USA.

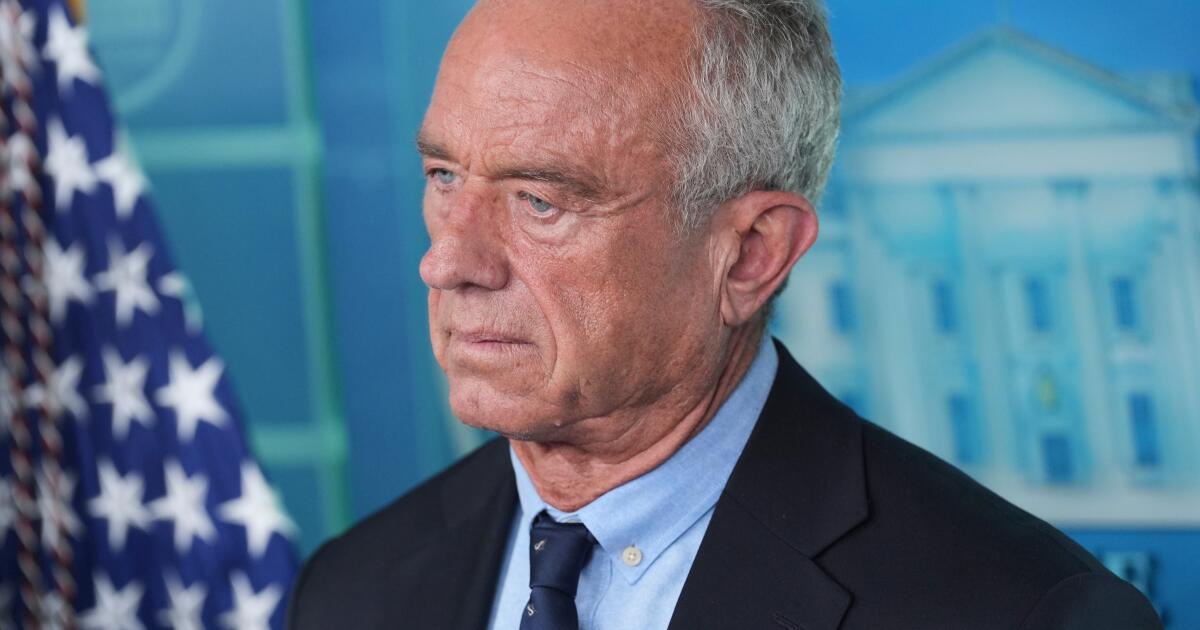

Mark Zuckerberg has similar thoughts.

. Meta CEO, the rapid development and increase of investments in AI bubblePotentially leaving behind practical productivity and returns and To risk a market accident. However, Zuckerberg insists that the risk of excessive investment is preferred to an alternative: being late for what he sees as a technological transformation that defines the period.

“There are compelling arguments about why AI may be contrary,” Zuckerberg is a appearance Open access Podcast. “And if the models continue to grow in capacity compared to last year and the demand continues to grow, perhaps there is no collapse.”

Later, Zuckerberg joined the Altman camp and said that all capital expenditures, such as the creation of AI infrastructure, which is largely seen as data centers, tend to end. “But I think at least empirically, I think there is a possibility that it is based on past large infrastructure structures and bubbles, Z Zuckerberg said.

Zuckerberg pointed out the past bubbles, namely the Dot-Com balloon, as the main examples of infrastructure structures that lead to the collapse of the stock market. In these cases, too much debt, macroeconomic factors or product demand decreased, claiming that bubbles occurred, causing companies to enter and fall behind valuable assets.

Comments of Meta CEO, Similarly warned AI explosion shows many symptoms of a balloon.

“When there are blisters, smart people are extremely excited about a real core,” Altman said. DonkeyAdding that AI is this nucleus: transformative and real, but often surrounded by irrational enthusiasm. Altman also warned that the cash frenzy that chases anything with ‘AI’ labeled ‘can lead to inflatable values and risks for many.