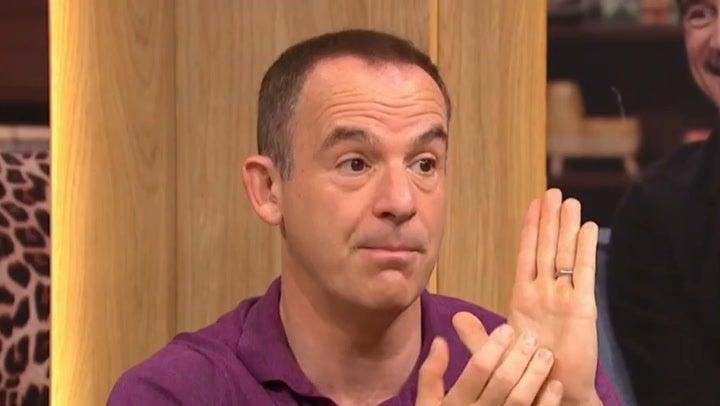

Martin Lewis reveals how to save £1,000s on council tax in three steps

Martin Lewis has shared his tips for saving potentially worth thousands through some little-known council tax tricks.

As bills continue to rise in 2026, the money expert has advised households they may be overpaying on local authority tax, offering three key ways to check.

His advice comes at a crucial time; Council tax bills will rise by a maximum amount once again in England and Wales in April.

Council tax reductions can be made for a variety of reasons, while property bands can be challenged under certain circumstances to reduce monthly costs.

Mr. Lewis recently announced Money Live Show (ITV) said one viewer saved “just under £6,000” using this method after the council tax band on the property he had lived in since 1994 was revised.

The money expert said: “£6,000 is middling for the successes I’ve had. I’ve seen 10, 11, 12 thousand. It’s very important to do that.”

Here are Mr Lewis’ top three tips for reducing council tax in 2026:

Challenge the council tax band

One of the main ways people can reduce their council tax is by ensuring they are in the correct property band, which determines the rate at which they will pay the tax.

Thousands of people were able to challenge the government on their property’s council tax band in 2023/24 (when data was last published), resulting in a lower council tax bill.

Official figures from the Valuation Office Agency (VOA) show that of the 43,820 people who requested a revaluation during this period, around 1,000 managed to reduce their band by two or more places.

Get a free partial share of up to £100.

Capital is at risk.

Terms and conditions apply.

ADVERTISING

Get a free partial share of up to £100.

Capital is at risk.

Terms and conditions apply.

ADVERTISING

Analysis by Mr Lewis’ MoneySavingExpert.co.uk estimates that around 400,000 households are in the wrong bracket and therefore paying too much council tax and should consider challenging the situation.

If successful, households will not only face a lower bill going forward, but will likely even receive a large backdated payment for the time they were paying the wrong level of tax.

Because the value of the properties is based on a 1991 assessment, the banding system is often criticized for being outdated. These values have changed significantly in recent years; Some areas have seen large increases in property values, while others have seen decreases.

However, revaluations are made according to 1991 market rates, not today’s prices. This means that VOA will consider a property’s physical characteristics rather than its current value.

Therefore, if the agency believes the value has increased since the last inspection, it may place the property in a higher tax bracket.

In very unfortunate cases, revaluation can also result in neighboring properties being placed in a higher band.

Check for discounts or support

There are a number of reliefs that can be claimed on council tax for eligible households worth up to 100 per cent, but in most cases these must be applied.

One of the most common is for people living in one property only; This means they can claim a 25 per cent reduction in council tax.

Student households are eligible for a 100 per cent reduction in council tax, as are adults deemed to have severe intellectual disability (SMI). If the SMI adult remains with a live-in caregiver, the discount is reduced to 50 percent.

Councils also offer discretionary relief for those facing serious hardship, meaning they cannot afford their council tax bill.

This is done on a council basis, so eligibility varies, but will generally include having an income below a certain level, receiving certain benefits and possibly having an illness or disability.

Reclaiming overpaid council tax

Finally, individuals can claim back overpaid council tax from an authority for payments over £100.

MoneySavingExpert.co.uk reports council tax payers in 349 local authority areas in England, Scotland and Wales are owed £141 million and more than 800,000 households are affected.

There are various reasons for being in debt to someone. For example, they may pay council tax in advance and then move house or forget to cancel the payment.

A taxpayer may even be owed a retroactive deduction if a property they previously lived in is rezoned; this means they overpaid while living there.

Some municipalities offer an online form to submit a request, while others require those interested to email or call.