My enemy’s enemy. ASIC, Matt Comyn, Geoff Shannon and John “Wacka” Williams

A senator John “Wacka” Williams was strongly uneasy for the 2017 Banking Royal Commission. Currently, CEO of Commbank Matt Comyn’s advisor. Do you have more in the story? Kim Wingerei Does he ask?

The revelation of John Williams is the adviser of Matt Comyn, Chief of Commbank, comes at an interesting time. The National Anti -Corruption Commission (NACC) deals with a case directly linked to ASIC’s role in a settlement arrangement to the former partner of Comyn’s other bank agitator Geoff Shannon.

“It sounds like an infinitely curved vapor novel, Shan said Shannon. MWM. “There is a relationship between a bank’s lawyer’s lawyer’s girlfriend and a high-level national Australian Bank (NAB) manager completed with e-mails-speaking e-mails. Later, the same woman, Natasha Keys, poured 16,000 documents into ASIC to torpedo her ex-boyfriend’s career, after making a secret $ 300,000+ pay from the bank CBA. “

Shannon is the founder of the unhappy banking, where he gathered hundreds of CBA-Bankwest victims against predatory loans and where the Queensland Magistrates’ Court closed the door to the ASIC’s case in November 2023. Shannon, who was accused of withdrawing ropes in the PTY LTD (BAPS) ropes in accordance with the 206a department of the Companies Law, was acquitted when the peace trial could not prove that the prosecution of Bamberry was involved in the basic decisions of the company.

The court broke the mixed bonds between unhappy banking (a high -profile advocacy outfit) and Baps (a fee charging consultancy), together with witnesses such as the original Baps director Robert Fitzalan, who swear to Shannon.

“Hello baby” Case: ASIC Witnesses brought to court, Commank is embarrassed, the evidence suddenly ends

During the trial, a network of disjudice, oil-can settlements and organizing blind spots emerged. And now, about two years later, Shannon’s struggle, the National Anti -Corruption Commission (NACC), and Shannon asked him to investigate the allegations of political back -room agreements, which he proposed to ignite the entire confusion.

Leaked e-mails and late night confessions

In 2014, it started innocent enough, or it looked like that. At that time, Shannon’s partner and Baps Director Keys was balanced with Big Four Banks and customer disputes. However, the court transcripts later presented a relationship with NAB’s Corporate Banking Director Simon Graystone. While defending the victims against drying, they were bleeding them dry, and whispering the secrets in the sheets.

A E -Postada Keys, who was read in court, wrote to Graystone and wrote him about a vulnerable NAB customer about the Media Blitz of Shannon’s unhappy banking Media Blitz, about a disabled woman who was forcibly evacuated by NAB. Plan? Leak the story to channel a current issue to force a settlement.

In court, Shannon’s defense lawyer Saul Holt KC, 30 times until he calls privilege against accusing himself. His reliability was broken, E -mail showed that Shannon had a rival initiative behind him, and the banks contradicted his statement claiming that he had left the Baps because he had left him.

As it is understood, Keys had his own personal war with CBA and met with CBA CEO Matt Comyn in 2018 and negotiated an agreement on a $ 272,000 poverty in addition to izlik equality and compensation for $ 309,000.

Why was Australia’s CEO personally involved in Keys’ case with $ 1.35 trillion asset and more than 50,000 personnel. Immediately after the settlement, Keys returned to the journalist Ben Butler to publish stories about Shannon, and gave ASIC as a star and volunteers as a star witness in the case lost by Asic.

Under Holt’s cross -fire, ASIC researcher Nathan Miller Squirmed admitted that Shannon had taken the excavation evidence of the excavation evidence that Keys was “in a hundred value”. There is no confirmation of the relationship, no investigation into the wind of CBA-a “one-eyed gerçek in a hurry to be tried only. The magistrate ordered the bill to scan the defense to ASIC in 16,000 files that were not disclosed.

How did everything start?

Geoff Shannon tells MWM He believes that his problems started years ago. In 2013, John “WACKA” Williams later learned a silent lunch between a Crusader Citizen Senator against the Bank’s Office and then the CBA General Advisor David Cohen.

Williams had his own history with CBA, CBA’s mid -eight -year -old (such as documented in Adele Ferguson’s “Banking Bad” book), the CBA has lost its farm after withdrawing in the middle of the eight of the eight of the CBA. When he was elected to the Senate in 2008, he became an open oral critic of bank behavior and was one of the chief agitators of the Banking Royal Commission. In 2019, he retired from the Senate.

Shannon claims that Cohen and Williams have signed a secret agreement that translated the script. Suddenly, Williams softened in CBA review. Shannon also refers to the confidentiality around the Bankwest stock agreement. He had a copy and Williams wanted to see it, but Shannon rejected it. Williams later armed strongly through Shannon’s media manager Ross Wareker.

When Shannon confronted Williams, threats flew: “Friends in high places buried him”.

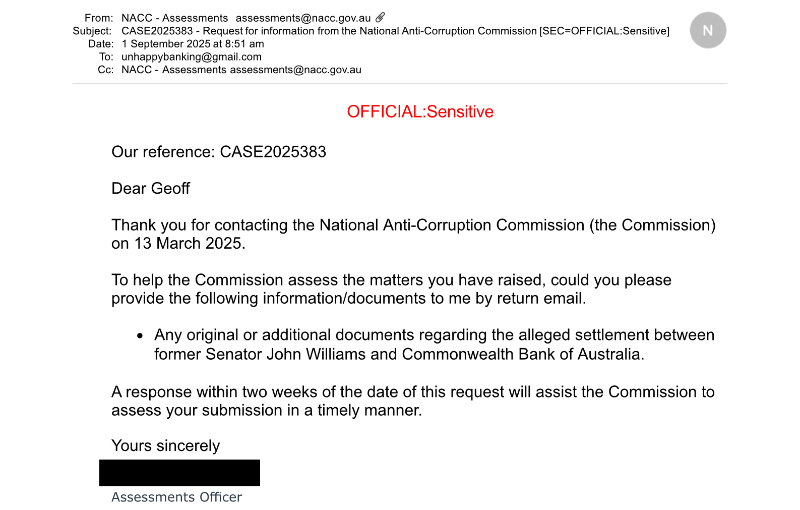

Enter Nacc

In September 2023, Shannon filed a lawsuit against Nacc, where ASIC was hidden against him and claimed that Williams used his influence with ASIC to go after him. He told Williams not to spill on Pm Tony Abbott about the “Secret Agreement” of Williams, including a lawyer, including a lawyer.

After rejecting the case for the first time, Shannon reopened another preliminary investigation after Nacc offered more documents. Shannon hopes that he can ultimately confirm his belief that Asic is very knowledgeable of Hell Fire.

In 2015, Shannon worn the storm from the previous ASIC slap (no disqualification) to the coup of this courtroom. However, while the Nacc took the bear, “My campaign is not over. Political strings have suffered from the very beginning of my ASIC.”

Ne So what is this alliance between CBA’s Comyn and Williams?

Banks are still vulnerable and favoritizers – why are you chasing a small frying while walking free casino kings freely?

Shannon’s epic emphasizes decay. Does justice bite at the end? Keep watching us, this mixed sex, secret and settlement tale is far from the last section.

MWM Put questions in both CBA only to media reports and John Williams, who answered.

“I met Matt for the first time when CEO. He created an effort to come to Invell to meet me. Valedictory just before my speech, Andrew Hall, who was PA for Matt, told the Advisory Committee of the Advisory Committee. to inform.

Yes, we receive payments for each of the three meetings a year, but you will not trust payments to keep you alive. “

Commbank, corporate police and senior magazines, to overthrow the advocate of bank victims?

Kim Wingerei, a businessman returned to the writer and commentator. Passionate about free speech, human rights, democracy and policy of change. Originally from Norway, who has been living in Australia for 30 years. ‘Why was democracy broken – a plan for change’ writer.