‘No value’: bank defends dropped no-deforestation plan

Australia’s oldest bank has faced criticism for reneging on commitments made under its previous leadership to stop lending to customers involved in deforestation or fossil fuel extraction.

The deforestation policy proposed by previous CEO Peter King two years ago would have required agricultural borrowers to pledge not to convert natural forests for agriculture from December 31.

“Customer feedback has been clear,” new CEO Anthony Miller told the bank’s annual general meeting in Sydney on Thursday.

“Instead of dealing with additional banking requirements, they need more help navigating existing regulations and demands.”

Mr. Miller said customers “and the entire ecosystem they operate in have made it clear to us that this has no value.”

“When we talk to our customers, they have an outstanding approach to managing their land and ensuring their farming properties are sustainable and continually improved.”

He noted that Australia already has a number of laws and regulations that affect what people can and cannot do with their land.

Jonathan Moylan, corporate campaigner for the Australian Conservation Foundation, said the idea that deforestation commitments “provide no value” ignores the enormous benefits forests provide for food systems, ecosystems and the economy.

“Westpac’s comments today cast doubt on what action the bank will take if habitat is threatened in ways that would not be lawful, which is the minimum expectation of any business in Australia,” Mr Moylan told AAP.

Westpac also recently backtracked on a promise made three-and-a-half years ago that it would no longer finance oil and gas companies without credible climate change plans from October 2025.

Kyle Robertson, of activist group Market Forces, told the meeting: “Here we are at the end of 2025 and, rather than honoring this critically important commitment, Westpac has chosen to put itself in a position to continue funding companies expanding fossil fuels indefinitely.”

“Banks like Westpac enable a handful of companies to trigger devastating and irreversible climate collapse.”

Chairman Steven Gregg said Westpac was the largest lender to the renewable energy sector in Australia and its exposure to the fossil fuel sector was small at 0.6 per cent.

Its exposure to oil and gas extraction has fallen by 10 per cent in 2024/25 and now represents just 0.1 per cent of Westpac’s total exposure.

There were no corporate loans on record to thermal coal mining customers.

Mr Gregg added that all of his clients in the fossil fuel industry should have a climate transition plan.

“It would be naive to think that they could change in a short period of time or go out of business altogether and we would influence that,” he said.

“But they need to explain it for us. You have to have an ambition to reduce emissions and they have to have a plan that we can look at.”

Ambition is an empty word in this context, said Morgan Pickett, senior banking analyst at Market Forces.

“I may have a desire to quit smoking by 2050, but I may smoke very large amounts of cigarettes before that date, and you will continue to support that,” he said.

But shareholders have loudly rejected a two-pronged resolution backed by Market Forces that would require Westpac to prove how its fossil fuel financing is compatible with global climate targets.

According to preliminary counts, the resolution received 14 percent of the vote, with 85.7 percent voting against.

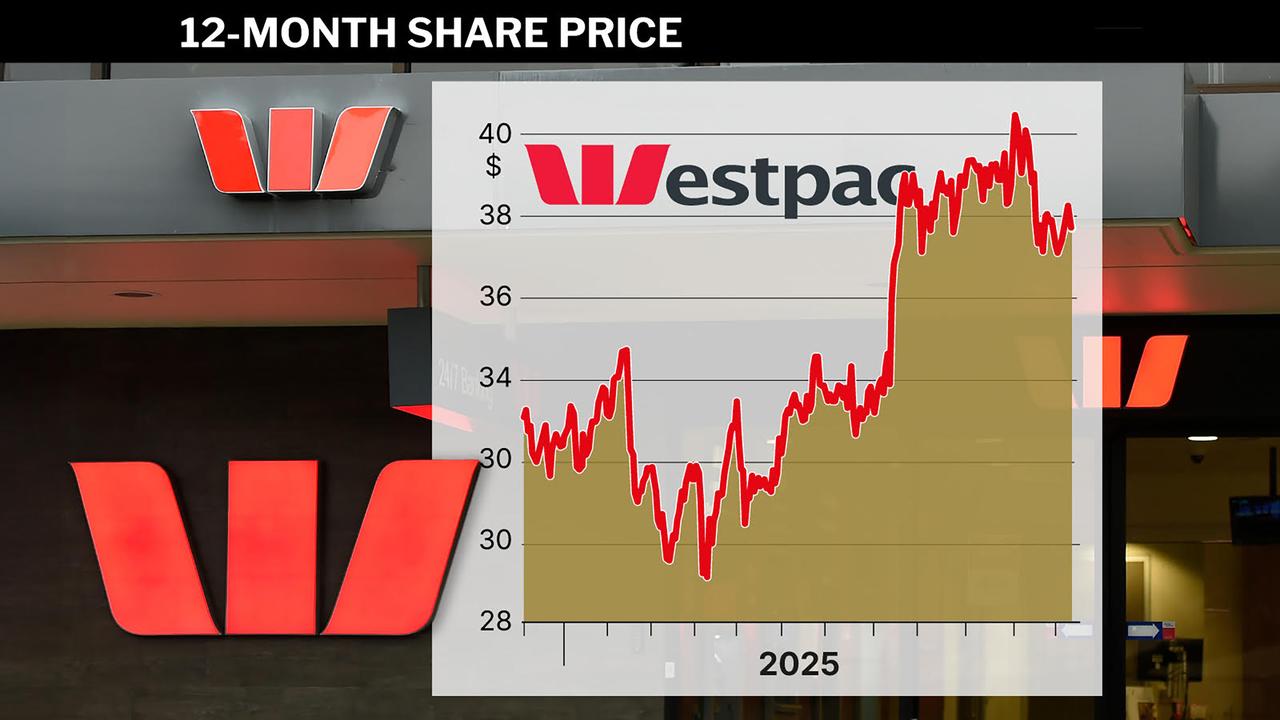

Westpac shares were trading up 1.17 per cent at $38.20 by market close.

Australia’s Associated Press is the beating heart of Australian news. AAP is Australia’s only independent national news channel and has been providing accurate, reliable and fast-paced news content to the media industry, government and corporate sector for 85 years. We inform Australia.