Rate cut looms as inflation result brings RBA ‘comfort’

Mortgage holders can be locked at a rate that is cut after two weeks after falling to the lowest level of the inflation measure of the Central Bank within three and a half years.

The Australian Statistics Office on Wednesday said in a statement, the average inflation that jumped the variable items to measure the underlying growth in prices was 0.6 percent in June quarter.

The result was compatible with the expectations of the economists and reduced the annual figure from 2.9 to 2.7 percent in March.

The average cut for the last time was that it was in December 2021.

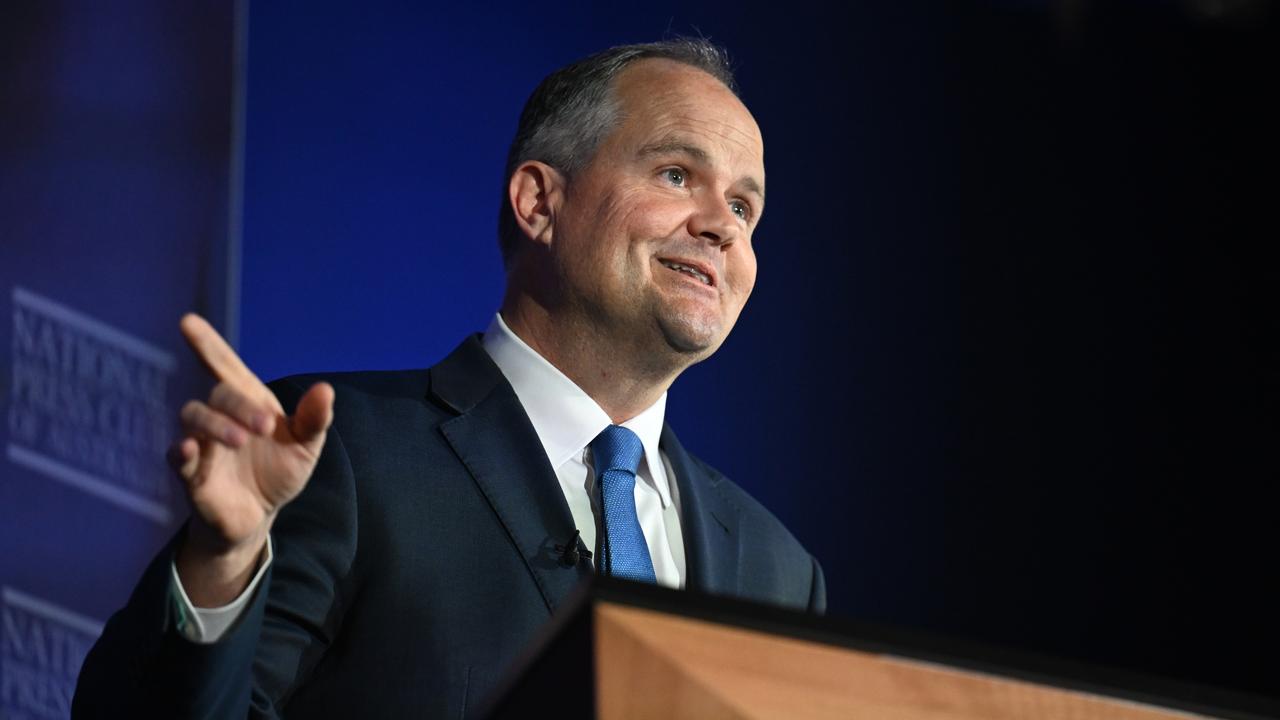

KPMG Chief Economist Brendan Rynne, Australia Reserve Bank’s July meeting by keeping the cash interest rate by 3.85 percent shocking the market after shocking the market, at the July meeting of 3.85 percent of the board to reduce the rates in August, “all the comfort needed”, he said.

“Since the last board meeting of the RBA, the arguments to reduce cash rates seem to have realized more than the arguments put forward to maintain more restrictive monetary policy environments,” he said.

“Before opening the wallets of consumer and work trust, households and investors’ wallets, seeking ratio aid.”

After the last meeting of RBA, Governor Michele Bullock said the board of directors expects the June quarter figures to confirm whether inflation is still on the way to reach 2.5 percent.

The result reflects progress progressing towards the midpoint of two to three percent of the RBA, although the Central Bank is slightly more than 2.6 percent estimation from May.

A recent increase in unemployment and the weaker household expenditures than expected supported the case for a deduction.

Jim Chalmers, a satisfied treasurer, grew up the outcomes while heralded the result.

“These figures, when we take office, represents a remarkable, extraordinary progress when you think that headline inflation is three times higher than these figures today,” he said.

“These are very nice, very pleasant, absolutely extraordinary inflation numbers.”

Economists and accounting companies of the four major banks confirmed the Oran Classes calls.

Money markets gave a chance of 95 percent without being released.

The merchants were pricing at least once again before Christmas.

CBA economist Harry Otley predicted that RBA would follow an August rate deduction with a 25 basis point reduction in November.

He said there was more risk for inflation to fall below the target, depending on being too high.

“There is little that shows that inflation risks will be recalculated in the inflation basket and that it will become an important problem in the estimation horizon,” he said.

Stock traders applauded the data, the Australian stock market jumped about half a point.

Title Consumer Price Index increased by 2.1 percent in June for 12 months.

Michelle Marquardt, ABS Prices President Michelle Marquardt, “This is the lowest annual inflation rate since March 2021,” he said.

While housing, food and health costs increase inflation further, falling gasoline prices received some steam from the index and reflecting lower global oil prices.

Shadow Treasurer Ted O’Brien said that the interest rates of the data are very high under labor, he said that he offered hope to the struggling mortgage owners.

“Comparable judicial powers have seen that interest rates were cut much earlier than Australia, Labour’s spending dependence and rates are located locally higher.”

25 basis points deduction, $ 600,000 mortgage repayments will be shaving $ 90 per month.

Australian Associated Press is a beating heart of Australian news. AAP has been the only independent national Newswire of Australia and has been providing reliable and fast news content to the media industry, the government and the corporate sector for 85 years. We inform Australia.