Sold 30 items on Vinted? Don’t panic if you get a message about tax

Jennifer Meierhansbusiness reporter

Getty Images

Getty ImagesJazz singer Billie van der Westhuizen started using Vinted about six months ago to sell clothes and shoes she hadn’t worn in a long time.

“I really got into it and was selling a lot of stuff,” he says. “Then I got a message saying I needed to enter my National Insurance number. It wasn’t clear why he was asking.”

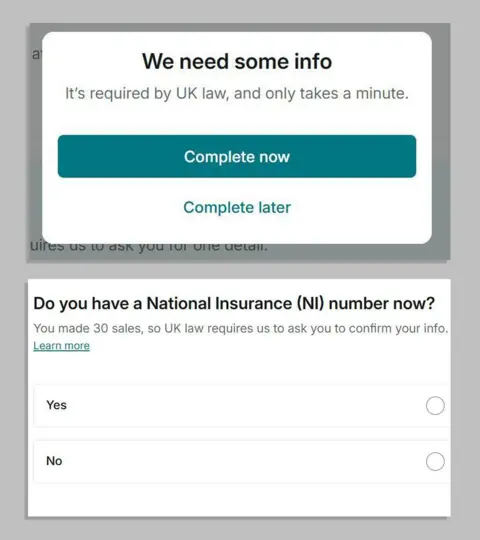

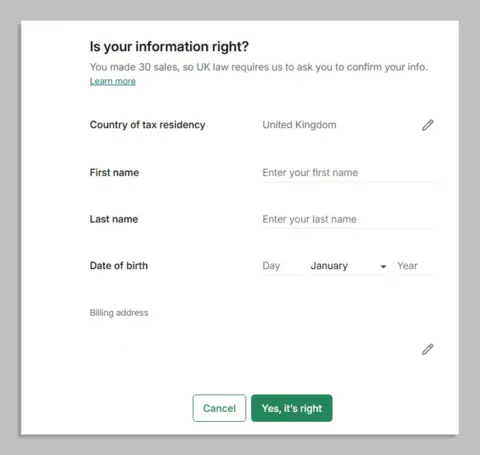

Vinted users who sell 30 items a year or earn £1,700 are being asked for their NI number, leaving many like Billie confused and some panicking they will have to pay tax.

But this isn’t about any tax changes; It stems from reporting rules for websites and applications that allow users to sell goods or services. eBay, Etsy, Depop and AirBnb.

Billie, 30, from London, said she entered her NI number as requested but in hindsight she wasn’t sure what it was about.

Billie van der Westhuizen

Billie van der Westhuizen“I just sent it, but I thought there was no way they would tax the money I made from it,” he says.

“Maybe if I were making thousands, but I think I’ve made £500 and I’m selling things for less than I paid for them.”

The pop-up alert Billie received sends Vinted users to a form asking for their name, address and NI number “as required by UK law”.

Some Vinted sellers have posted screenshots of messages on TikTok and Instagram asking whether they need to provide their details and whether they will be taxed if they do.

vintage

vintageOne user on Reddit posted: “Vinted wants my National Insurance number, does that mean I have to pay tax? I barely make any money from Vinted – what happens if I ignore this?”

Chartered accountant Abigail Foster says many people may panic when asked for tax information by Vinted, but for most users it’s nothing to worry about.

“If you’re just selling your own second-hand clothes or household items, you won’t owe any tax even if Vinted shares this data with HMRC,” he says.

“This rule is aimed at people who are effectively running a resale business, not people who are giving away their wardrobes.”

He adds that it would be very easy for HMRC to tell if someone is trading by checking multiple listings of the same product, or items that have been bought and quickly resold at higher prices.

New reporting requirements for digital platforms come into force on January 1, 2024, with the government saying it will help “reduce tax evasion”.

Vinted sellers reported receiving in-app messages requesting their NI number around this time last year.

According to Vinted, information must be shared with HMRC by the end of the calendar year when sellers reach the threshold of 30 items or £1,700.

vintage

vintageA spokesperson for HMRC said: “People remain responsible for their own tax affairs and for considering whether they need to file a tax return to report business income.

“As your side business grows, unpaid taxes may come to light.

“If you haven’t told us about the extra money you’ve earned, this could lead to an unexpected and possibly huge tax bill, so it’s really important to keep on top of your tax affairs.”

Research commissioned by HMRC in 2022 suggested that around one in 10 adults in the UK participated in what it called. “hidden economy” – Profits wholly or partially concealed from the tax office to avoid paying taxes.

What are the tax rules for online sales?

- Platforms must report to HMRC people who sell more than 30 products or whose total sales reach £1,700 per year

- This does not automatically mean that these people should pay taxes

- Selling your own clothing or other items is not taxable if you sell for less than you originally paid because you did not make a profit.

- Tax only applies if you’re buying shares to resell or making a profit of more than £1,000 a year

- If you sell an item for more than £6,000, you may be required to pay. Capital gains tax.

- you can use HMRC’s online tool to check whether you need to report your income to the authorities