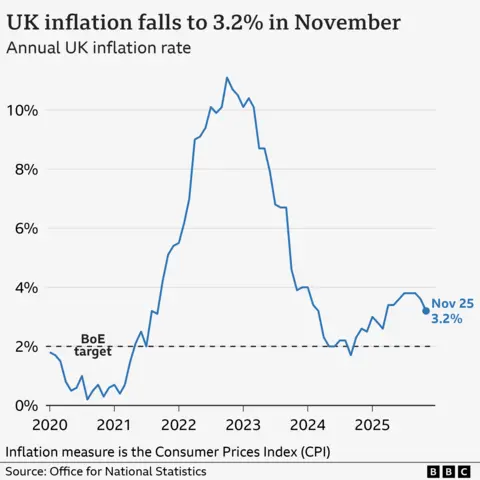

UK inflation dips by more than expected to 3.2%

Getty Images

Getty ImagesDeclines in food, alcohol and clothing prices last month helped inflation fall to its lowest level in eight months in November.

The inflation rate fell from 3.6% to 3.2%, a larger decline than analysts expected.

The main reason for the decline was lower food prices, “with declines seen particularly in cakes, biscuits and breakfast cereals”, according to Grant Fitzner, chief economist at the Office for National Statistics (ONS).

This comes ahead of the Bank of England’s interest rates decision on Thursday, with widespread cuts expected.

The decline in inflation will strengthen hopes that inflation has peaked, possibly paving the way for further rate cuts next year.

Other items that brought down inflation included tobacco, restaurant meals and hotel accommodations, furniture and transportation costs.

Prices are still increasing on average throughout the economy, but there were decreases in some items between October and November.

Food prices, the biggest driver of the low inflation figure, fell on a monthly basis, bucking the normal upward trend for this time of year.

Between October and November, food prices fell by 0.2 percent and rose 4.2 percent from November; There was a 4.9% decrease compared to November.

Chancellor Rachel Reeves said she knew families in Britain would “welcome this reduction in inflation”.

“Reducing bills is my top priority. That’s why I’ve frozen rail charges, prescription charges and cut average energy bills by £150 in the Budget this year,” he said.

Inflation in the UK is a measure of the Consumer Price Index, a basket of goods and services selected by the ONS that includes bread, fruit and different clothing items.

Reacting to the inflation figure, Paul Dales, chief UK economist at Capital Economics, said it was “particularly good news” that the rate of price growth was “being dragged down by the fun things we all want to indulge in at this time of year”.

He added that clothing and shoe prices may also recover after Black Friday sales end, but the overall picture “shows that the decline in inflation occurred faster than expected.”

Hargreaves Lansdown personal finance manager Sarah Coles said Black Friday sales were busier this year, which helped keep average clothing and footwear prices low in November.

“Slow sales have convinced retailers they need to work harder to get people in the door, so discounting has gotten even heavier this year, especially on women’s clothing and shoes.”

Danni Hewson, head of financial analysis at AJ Bell, said: “As Christmas presents go, this is a very welcome gift.

“It’s that time of year when people are putting a few more things in their supermarket trolleys, so news that food and alcohol inflation is falling will be a boon for cash-strapped families.”

He added that “just because inflation is falling does not mean the cost of living is getting cheaper” and that “many households are still reeling from the impact of the mega price rises we have endured over the last few years”.