UK inflation hits highest for almost a year and a half

Business reporter, BBC News

Getty Images

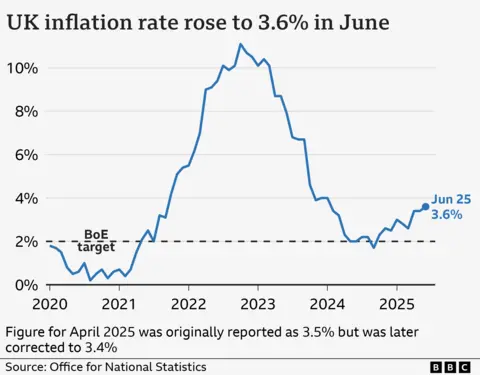

Getty ImagesNational Statistics Office (Ones) said prices increased by 3.6% in June, the fastest inflation rate since January 2024.

Higher prices and fuel prices for food and clothing, air and railway fees have a lower decrease in fuel prices than last year, all of them increased the rate further.

If the increase rate of prices, goods and services are rapidly becoming more expensive, it is important for those who do not go so far.

Inflation remains much higher than the 2%target ratio of the Bank of the UK, but a deduction in the borrowing cost is still expected at the next month’s rate determination meeting.

The speed of price increases affects whether the bank decides to increase or reduce interest rates as it can slow down inflation by reducing economic activity.

The higher figure for June was unexpected, the economists estimated that the inflation rate would remain at 3.4% in April and May.

Yael Selfin, the chief economist of KPMG UK, said that inflation will be at the top of 4% in autumn, including tax increases in April.

Richard Heys, Deputy Chief Economist of the British Official Statistics Authority, said that the biggest contribution to the high inflation of June has come from transportation.

Although gasoline and diesel are cheaper than a year ago, the price fell slightly between May and June compared to a greater decrease in the same month of the last year.

Ones, volatile aircraft, especially long -distance and European routes, he said.

The increase in railway fees came from more expensive tickets on international routes.

‘Foods collected’

Average wages increased by 5.2%last year, which shows that many people will not be worse in general, but shoppers, especially low -income ones, will be more affected by higher prices for daily staples such as food and gasoline.

Alissia Mardlin, a bartender from London, said that her rent in a common apartment was “extortion” with less backup expenditure money.

Orum I eat sweet belly and pasta, dedi he said, accusing the higher cost of living.

According to the figures published by ounce on Wednesday, a slightly slower speed compared to a month ago increased by 6.7% to May.

Housing prices increased again and increased by 3.9%.

Bishop’s Marketing Manager Jonathan Ballantyne from Bishop, BBC, said he did not notice much in the supermarket shop, but he noticed that he was stuck in gas and energy costs.

“I am more aware of not using a place because I think what the cost will be,” he said.

Saul, who did not want to share his surname, said he realized that coffee and beer were more expensive and that people go out and reduce the likelihood of socialization.

“Grocery stores are largely collected,” he said. “Food agreements in supermarkets have increased to a great extent – 50p increased because I could remember.”

Food prices have increased by 4.5% in June, which has been highest since February 2024, but far below the summit seen two years ago.

Food industry representatives, producers, chocolate, butter, coffee and meat for lock components such as higher costs, as well as higher energy and labor costs, he said.

Bad for protectors

High inflation figure follows the news last week The economy shrunk unexpectedly in May.

Chancellor Rachel Reeves said that people know that people still fight with the cost of living, but the government’s plans involved “put more money in people’s pockets”.

In his annual Mansion House speech on TuesdayChancellor, England stressed the importance of putting the path back.

The financial industry said that the preservatives who put money in stocks and stocks should change their “negative” narratives.

Personal finance broadcast spokesman Caitlyn Eastell, MoneyfactSCompare.co.uk, higher inflation is higher than average savings accounts, because people’s wealth is potentially “bad news”, he said.

He advised them to “shop” for their best saving refunds.

If the UK Bank reduces borrowing costs as expected in August, interest rates for the preservatives may further decrease.

However, Andrew Comence, a former member of the committee, which determines interest rates, said he believes that reducing rates with the rise of inflation on social media would be “irresponsible”.

Other commentators, including KPMG’s Selfin, are waiting for the higher rate to strengthen the cautious approach of the Bank of the UK.

Inflation is now well below the summits that Russia has reached after the occupation of Ukraine. It reached 11.1%in October 2022.