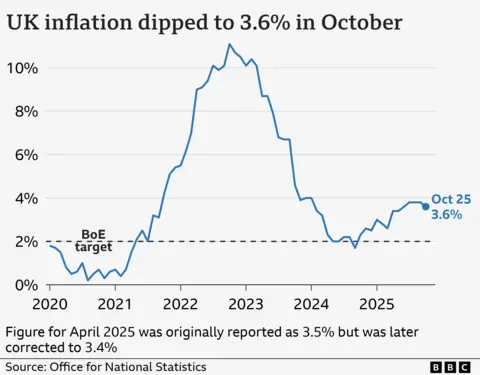

UK inflation rate falls to 3.6% in year to October

Lucy Whorebusiness reporter

Getty Images

Getty ImagesIn the UK, the inflation rate fell to 3.6% by October, but food prices rose again after falling in September.

The Office for National Statistics (ONS) said prices rose at the slowest pace in four months, driven by increases in household energy costs and lower hotel costs.

Economists had expected a slightly larger decline to 3.5% from 3.8% in September.

The latest inflation report comes just a week before the government’s highly anticipated budget.

“I’m determined to do more to bring prices down,” Chancellor Rachel Reeves said after the latest data was released.

“I recognize that inflation and the cost of living are still a huge burden on families across the country,” he said.

Reeves said easing cost-of-living pressures was one of the main objectives of the Budget and it was expected to include a combination of tax rises and spending cuts to shore up government finances.

The ONS said the biggest upward pressure on prices was coming from food and non-alcoholic drinks. The 12-month inflation rate in food increased from 4.5% in September to 4.9% in October.

Among the products whose prices increased were bread, meat, fish, vegetables, chocolate and confectionery. However, fruit prices have fallen slightly.

The drop in inflation to 3.6 percent means that prices are rising more slowly than before, raising hopes that inflation has peaked and paving the way for interest rates to fall.

Inflation remains above the Bank of England’s 2% target but the next interest rate decision on December 18 will focus on the long-term impact of the increase in borrowing costs.

“Inflation eased in October, driven by gas and electricity prices rising less than last year following changes to the Ofgem energy cap,” ONS chief economist Grant Fitzner said.

Household energy prices, capped by the regulator, rose during the year through October. However, the 2% increase in the cap was significantly less than last year’s 9.6% increase.

The ONS said another factor in the decline was hotel prices. Hotel prices usually fall between summer and Christmas, but this year they fell more than last year.

However, increased fuel prices have affected drivers and delivery costs.

“As the annual cost of raw materials for businesses continues to rise, ex-factory prices have also increased,” Mr. Fitzner added.

The Food and Drink Federation, which represents food manufacturers, said food price inflation was driven by rising material and energy costs as well as “regulatory costs” including packaging duties and increased National Insurance.

Relaxation

Sarah Coles, head of personal finance at stockbrokers Hargreaves Lansdown, said: “If you’re wondering what this warm breeze is about, the whole country is breathing a sigh of relief at the news that inflation has fallen for the first time since March.”

Slower price increases would help ease pressure on households, but would also help mortgage borrowers if interest rates fall, he said.

Rob Wood, UK Chief Economist at research firm Pantheon Macroeconomics, said he believed the rate cut in December was now “certain” but predicted “a long delay until another cut” after that.

Shadow chancellor Sir Mel Stride said: “Inflation has run above target every month since Labour’s last budget, leaving working people worse off.”

Liberal Democrat deputy leader Daisy Cooper said the chancellor “must not look this little gift horse in the mouth” and called for “urgent measures to reduce people’s energy bills” and a VAT cut for the hospitality sector.