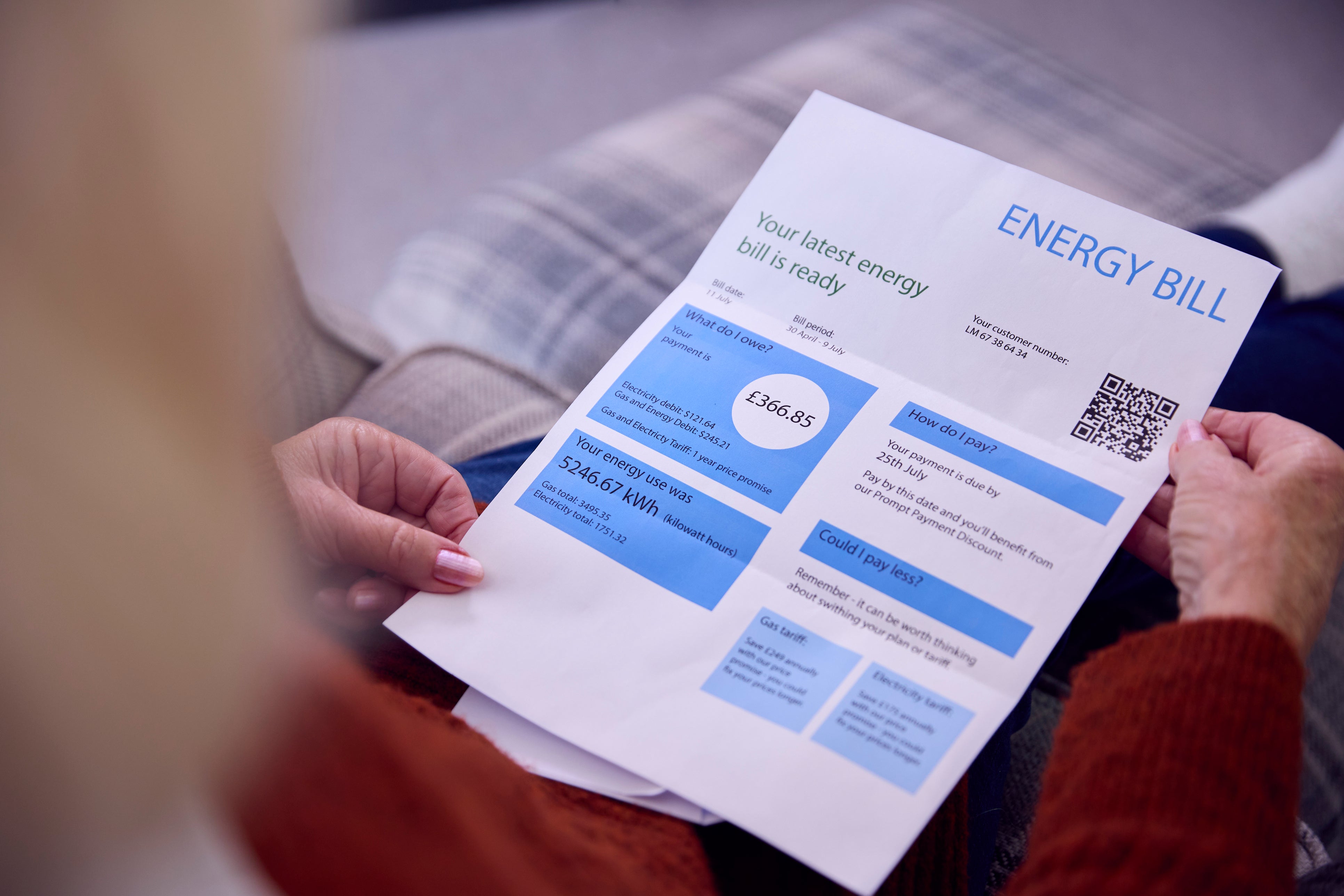

Cos of living crisis sees household energy debt triple in 10 years

According to a report, the British household energy debt, the cost of life costs, as their families pushed the priority bills to debts.

According to the Decision Foundation Research, the number of customers returning to electricity bills without reimbursement plan was made in 2012 from 300,000 to 2024 to more than one million times at the end of 2024, and the number of customers left on gas bills increased from 300,000 to 900,000 during this period.

The money report in my mind shows that positive trends between low to medium income households contain savings and falling credit card debts.

However, there were increasing energy debt among new financial concerns for families and Council tax debts that should be handled ”.

The report said that the poorer half of the 13 million working age in the UK is still struggling to save, and two -fifths were less than £ 1,000 in the current savings.

However, the average amount owed by all these families fell from £ 2.617 to £ 2,256 in 2006-08 at £ 2,256-a real decrease of 14 in a hundred.

In the meantime, the problem of debts such as “priority” household invoices such as energy and council tax increased significantly.

Since the eve of the pandema, the Council tax debts in the UK rose to £ 6.7 billion in 2019/20 from 4.6 billion to £ 2024/20.

One million electricity and one million gas customers are currently behind their invoices, and the average size of their debts rose from £ 500 to £ 1,600 between £ 500 and 2024, while the average debt for gas rose from £ 500 to £ 1,400.

The report said that the income distribution of at least one -fifth of a family (18 percent) of these debts is the fifth highest of the income distribution.

The increase in debts was mainly due to the increase in the bills, and families paid 50 percent more for each gas unit they use before the energy crisis.

Meanwhile, the unification of the decreasing Council tax support and increasing invoices has increased its burden on the poorest households.

The report calls for a social tariff on the improvement of Council tax support and energy bills.

The Solution Foundation Economist Felicia Odamtten said: “The financial flexibility of families has been tested with a number of financial shock in recent years as well as stagnant revenues.

“Although families have managed to impressively reduce credit card debt and save more, new financial concerns have emerged with debts about the explosion of priority bills.

“To overcome these financial problems, it will require additional assistance to priority invoices such as improved Council tax support and a social tariff on energy bills. However, often, lack of financial flexibility is a result of lack of income, and addressing it will mean to correct the terrible record of England’s productivity and real wage growth.”

Debt Charity Stepchane Communication Chairman Simon Trevethick said: “This research talks about what our consultants see daily basis – the weight of daily costs pushed the households to the threshold.

“More than two-fifth of five step-elections in energy debts, this is one of the most urgent issues they encounter. For the Council Tax, the risk of debt increases and outdated imprisonment increases to a large extent to those who are in difficulty-average debts exceed £ 2,000.

“There are practical steps that consumers can take – correct your energy tariff in front of the price limit changes that come into force, reduce the use of energy daily if it is safe to do so, and access your power provider, local authority or if you fall into debts.

“However, these are gluing gypsum measures for a much deeper wound that requires movement from the central government. We need to see a debt evacuation plan to address historical energy debts, a basic revision of the Council tax regulations – including the end of the imprisonment – and immediately action to create household financial flexibility.”