House prices on the rise again – but one property type is bucking the trend

The real estate prices in the UK rose once again in September after a slight decrease in August – but new numbers show that apartments are in favor of the buyers.

Data throughout the country show that prices increase from month to month and increase annual prices by 2.2 percent.

However, statistics show that there are great differences in price changes in the north and south of England and in the type of property.

The semi -detached features increased by 3.4 percent in the last 12 months, while detached (2.5 percent) and terrace (2.4 percent) saw a slightly slower price increases. The cost of the apartments continues to decrease and average prices decreased by 0.3 percent.

The figures also show that the price of a typical apartment has increased by 20 percent in the last 10 years – less than half of the price growth of terraced houses in the same period.

Despite the years of price increase, the third quarter of 2025-July-September- has slowed down the price increases that experts believe that people believe that they were cautious about their money and plans.

Bestınvest Personal Finance Analyst Alice Haini said, “Annual growth remained at a rate of 2.2 percent – a slightly higher growth rate than August, but the majority of regions saw a modest slowdown in the annual home price growth in September”.

“The vortex of the speculation has directed some buyers to pause their purchasing plans, especially at the top of the market. This can reduce market activity over the next few months if buyers wait to see what they are fighting before the commitment.

“The sellers respond more competitively by pricing, they acknowledge that buyers meet not only higher purchasing costs, but also the uncertainty that comes with possible tax changes.”

ADVERTISING

ADVERTISING

Although it is a property type, the location.

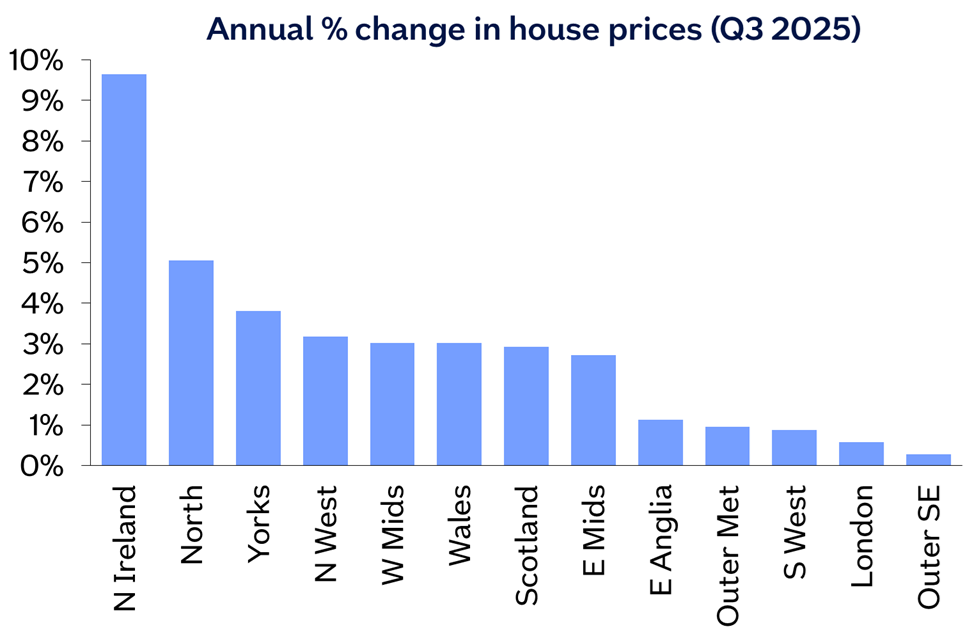

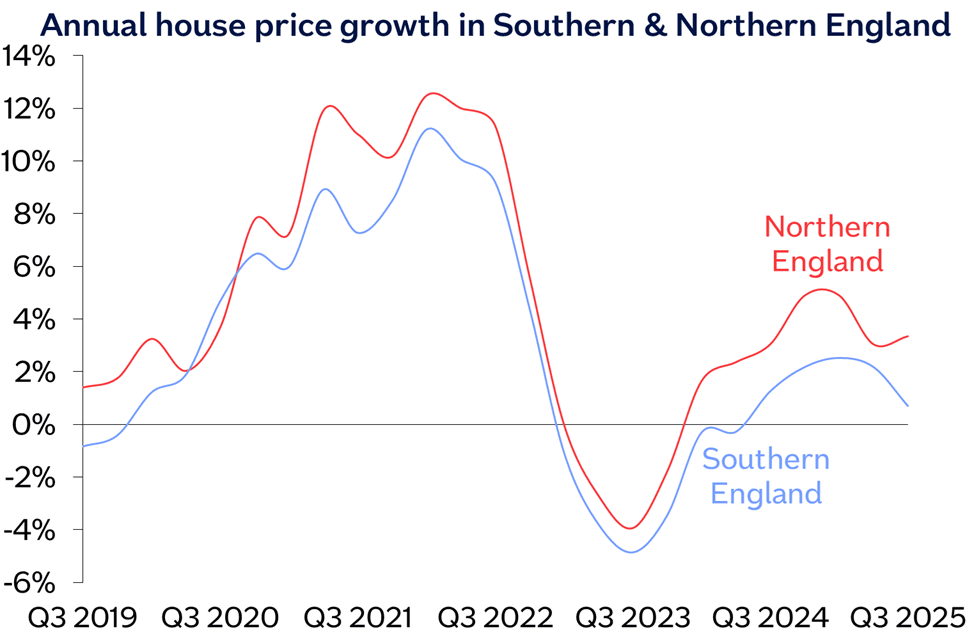

Houses in Northern Ireland and the UK continue to see that price growth has left this far behind in the south.

Garrington Property Finders CEO Jonathan Hopper said, “Slow down in the suburban belt around London.” He said.

“The problem here is that the number of sellers leaves the number of serious buyers too much. Even in very desired areas, sellers are only sweetened to the buyers ‘stamp tax costs to make a sharp pricing to the buyers’ attention to attract the attention of buyers.

“This problem is combined by the uncertainty surrounding the budget of the next month. An rumors of shaking in property and reserve taxes caused many optional buyers to sit in their hands, and this applied the brakes to prices in prime areas. In particular, the Bank’s Bank’s base is the highest probability of reducing August.

“Although these factors are important, the market is ultimately guided by supply and demand forces – and where the gap between the north and south is transformed into a Gulf.

“The average prices in Northern England increased almost five times faster than in the third quarter of the year, and Scotland and Wales recorded their growth rates four times higher than Southern England.”

Detailed housing prices in northern England regions, 5.1 percent annually in southern UK compared to 0.7 percent increase.

Tanya Elmad, the manager manager, “The property industry remains in the dark on the potential changes in the tax regime in the autumn declaration. Rumors such as a potential real estate tax in houses with more than £ 500,000 will significantly affect the market, but the future uncertainty can be suppressed until more clarity in the budget.

Foxtons CEO Guy Gitins, “Christmas who want to complete their sales before the sellers now need to enter the market with the right agent and an additional sense of urgency,” he added.